Interesting insights - June edition

A quiet month with markets narrowing and summer dawning

Dear readers, I can no longer start every post with “this is my first time, please be kind”. The substack has grown beyond my first hundred subscribers, and my first proper deep dive has been read by almost 2000 people. I’m surprised and very happy that people have found my writing interesting. Thank you so much for reading my scribblings, and for joining me on this learning journey - let’s all continue to try to make a proper splash in the markets going forward!

June has been a slow month in the markets for me. My market activity has mostly been adding to existing positions, but one new company have snuck into my portfolio. As summer arrived, time has also been spent mostly outside with friends, or in pubs watching football. This means the monthly newsletter will be shorter this time around.

I also want to wish everyone a great summer! I hope you get to spend time with friends and loved ones, and that you enjoy this lovely period of the year.

Portfolio updates

Alimentation Couche-Tard first quarter summary

June is a very quiet month for earnings and company events. Only one of my companies has reported earnings this month. Alimentation Couche-Tard reported its 2024 Q4 earnings 25.06, showing troubling headline numbers. The result for the full financial year ended up with an EPS decline of 7.8% compared to 2023 for ATD. On a quarter-basis the decline was more dramatic, with a decrease of 32.4% in EPS compared to q4’23. The comparable year and quarter is described as tough comparisons by the company, however I do not want to sugar coat this as a good result from ATD.

They seem to be struggling to integrate the recent Total Energies acquisition (which added almost 2200 sites in Europe) and get margins in line with the rest of the group. They also experienced similar struggles earlier in Europe, but did end up getting new acquisitions in line after a couple of years. I believe that ATD has proven their track record of acquisitions and integration, and I have no fear that this too shall pass.

In other ATD news, Brian Hannasch, the CEO of ATD announced his retirement right before the earnings call and that Alex Miller will be appointed to the position in september.

The exit of Hannasch has been described as him retiring. I find that hard to believe, and the wording during the conference call sounds very much like he’s leaving due to business related reasons.

Alex Miller has a long track record with ATD, and has been with the company for 12 years. No need to fuss too much about leadership change, however it will be something that I pay extra attention to going forward. Alain Bouchard (co-founder of ATD) said this after the leadership change: "Couche-Tard has only had two CEOs during its almost 45-year history, and we take this appointment extremely seriously.” Talk about stability and longevity!

The talk surrounding ATD is focused on fuel margins, and whether or not we’re at peak margins. Without spending too much time, I believe that the gas station sector is ripe for consolidation, and that a potential fuel margin drop will lead to increased speed for M&A in ATD as opportunities present themselves when smaller and less profitable actors start to struggle.

It’s also important not to stare to much at fuel and remember the revenue and gross profit mix:

More and more of gross profit comes from the categories merchandise and service and other. There’s also a lot of profitability to gain from working with the European part of the business, as the discrepancy between revenue and gross profit in Europe & Other (Hong Kong is a major market in the Other geography) is not sunny.

In other portfolio news I’ve added one company to my portfolio this month: Paradox Interactive. They are a niche gaming developer who has struggled with some game launches the last year or so and the market has punished the stock price. I believe that this presents an interesting opportunity for long term owners, and I am happy to be a PDX-investor. I’m currently working on a deep dive on the company alongside

who writes the Outsider Corner, and we hope to finish it some time this summer!I’ve added shares in Evolution AB and SanLorenzo. SanLorenzo is now one of my top five holdings, and I’m even considering buying more given the recent share price development.

Norbit to acquire Innomar

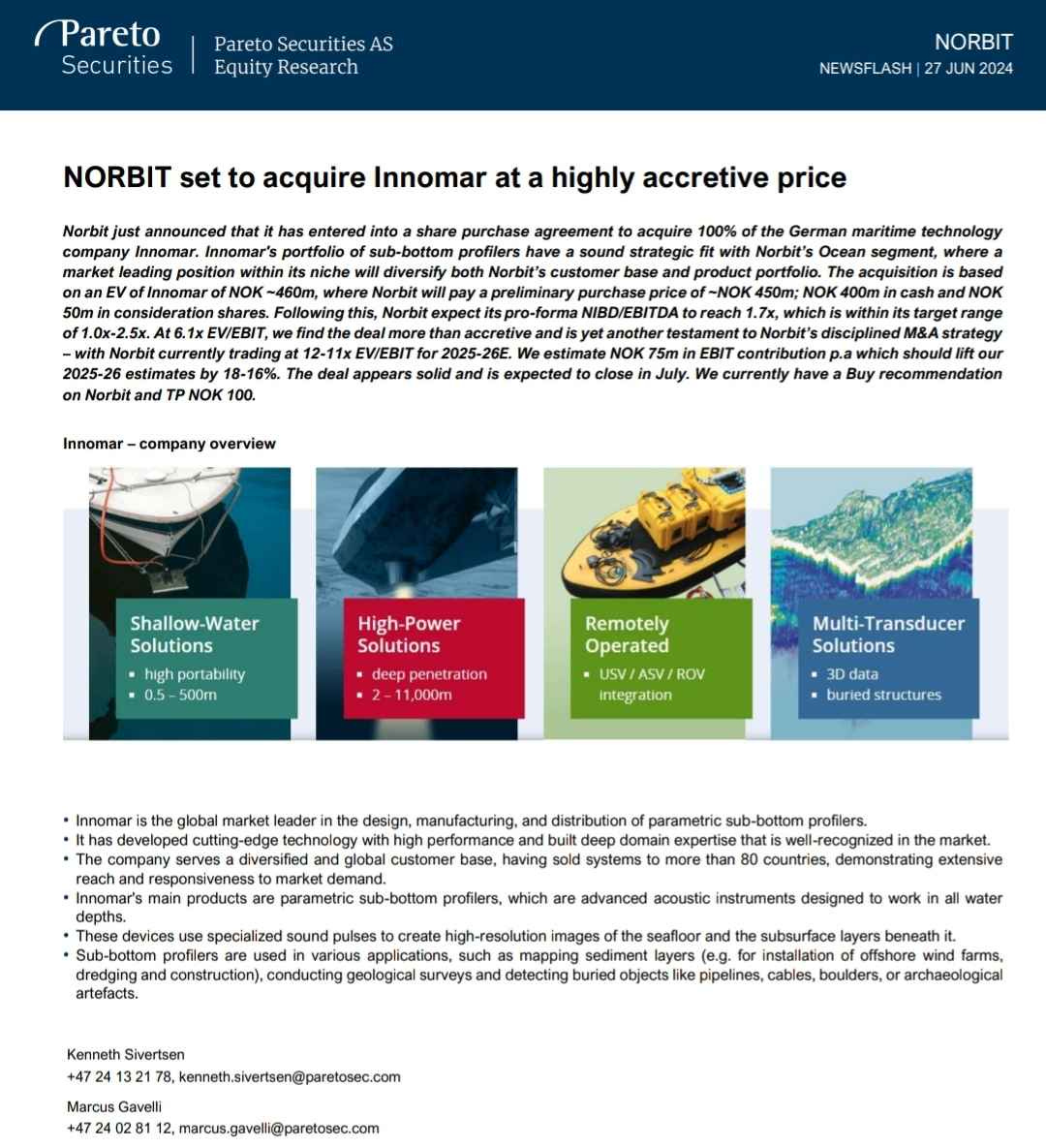

Norbit announced that they are buying the German company Innomar for the total price of €40.5 million, approx €35mln in cash and rest in Norbit stock for management. Innomar provides sub-sea mapping software and technology, and looks to be a great fit. The company describes the acquisition as a great fit, and I can definitely see where they are coming from:

Pareto Analysis describes this as a great acquisition, with the potential for a 16-18% increase in EPS. The company was bought at a pricing of 6.1 EV/EBIT (Norbit itself is trading at around 11-12x EV/EBIT), should contribute around 75mln NOK to bottom line and is a great product fit expanding their core offerings. Innomar grew its sales at a 15% CAGR in the last 5 years, and have around 25% EBIT margins. Great deal in my opinion, and it got the share price breaking into new heights.

Let’s not forget that the financial goal of Norbit is a revenue growth of 16% annually the coming three years. If Pareto is correct in their assessment of the effect of the Innomar acquistion, they have made a substantial step towards achieving these goals already in the first year of their new strategic period.

Interesting stock pitches

SanLorenzo deep dive by

. Great overview of a very interesting true luxury company that I’m happy to own myself:Run down on some great international IT-consultancy companies:

on implied return on Topicus at current share price level:A side by side look at Apple and PayPal:

As I’ve been adding to Evolution AB these last months I found it interesting to read an alternative take and decision from

. I don’t disagree with the points being raised, however the conclusion I obviously don’t agree with:Will AI kill Teleperformance SE?

A shallow dive on Ferrari:

An interesting pitch of some defensive stock plays for Latin America:

Investment insights

Luuk from

has read every single Rochon annual letter, and have been so kind as to distill his learnings into this great article. Rochon is definitely one to learn from, and this article makes it much easier!An interesting perspective on disagreeing with market pricing and how to take advantage of that:

A great reflection piece on portfolio construction:

A great rundown on the effect AI currently is having on CRM, and Salesforce in particular.

What the hell is a spaghetti sauce strategy? Read on and find out:

Lessons from great investors by Compound & Fire:

Podcasts I’ve listened to this month

John Elkann, CEO of Exor N.V., the stewards of Ferrari, Stellantis and many other great companies gives a rare public interview:

I’ve been on an Acquired binge - great show to really dive deep into companies history and achievements. This month I’ve been able to listen to their rundown of Nintendo. Nintendo is just an amazing story to learn about, and a puzzling piece of business history, being central in the development of the gaming industry:

More Nintendo, but also a great discussion on stock picking and how to think about investing:

A very interesting discussion on one of the highest quality companies in the world, Lifco:

That’s it for the June edition of interesting insights! I wish all my readers a great summer, and hope you get to kick back and relax. Personally I will probably try to tune out of stocks for the vacation, and enjoy the company of family, friends and travels with my partner.

Nothing I’ve written in this article should be understood or interpreted as investment advice. I’m a simple hobby investor who likes writing, and I am not competent or qualified to be giving investment advice. Do your own research, be critical of my assumptions and look into the companies discussed before making any investing decisions.