Dear readers,

November was a hectic month, but as fall moved over to winter my time related to the market became more introverted. I have spent less time discovering new cases, and more time on reading and looking at my investing from a conceptual level so to speak. It’s also ever interesting following the markets in times of big events such as the american elections, or the good old earnings seasons. It’s easy to forget that the common mode of the markets are usually a lot calmer than in these periods.

I have also had some time to reflect on my writing. When it comes to these monthly updates, I haven’t really been able to decide what I think about the format. It’s original intention was that it was a way for me to journal my thoughts and what has happened with my portfolio. It quickly snowballed into a format in which I try to detail everything that has happened in my portfolio holdings these last months.

These schematic monthly updates is something that I am not really sure gives a ton of value to my readers, and it has made writing these posts a bit of a chore. I will therefore not go through each and every quarterly report for the month of November, but I will try to touch on the stuff that sticks out in earnings. I will of course continue to be transparent with the moves I make in the markets. In the end, I have learned to know myself well enough to know that when things start feeling like a chore, I risk losing the joy of doing something. This is bound to shine through in my writing.

Oh well, enough introspection.

Portfolio news

Yet another month, and I bought some shares and I sold some shares. Most noteably for those who follow me I sold shares in: Paradox Interactive and Omda AS. The proceeds of these sales went into buying more shares of Medistim ASA and opening a position in ASML.

The rationale behind my sale of Paradox popped into my head when I wrote about my investable universe. I realised rather quickly that Paradox Interactive and the gaming industry at large is not something that would have made it into my investable universe. The stock has climbed quite a lot from the bottom, and I made an alright trade on it with 35% or so these last 6 months. It’s a really fun company to follow, and it is probably still a very attractive investment for those who hold shares in the company.

In regards to the Omda sale, I quickly grew uncomfortable with the company after they issued new shares to fund the acquistion of Predicare AB. This is a weird one, they currently have an ongoing buyback program going. The shares from this program can’t be deleted, and are destined for funding of future acquistion due to their bond agreement prohibiting them from paying shareholders over bondholders.

I wrote about the rationale on Twitter and I believe there are sensible reasons for paying for the acquistion with issued shares as the share price is far below the average price of bought back shares. However, it is an unusual approach to funding, and dilution is never good. The case became even more muddy than it was in the outset, and I decided to wait this one out. I thankfully got out at around breakeven. Below, you can see the amount of the various settlement options Omda had in their Predicare acquisition:

I keep thinking about Omda though, and there is some allure to the case that keeps drawing me back. I will try to tie the knot on the Medistim deep dive that I have been working on for far to long, and then turn my attention to Omda.

Adding to the Medistim position, and the buy of ASML is easier to explain. Medistim got a real hit in the share price, all the way down to 135 NOK or so, and I couldn’t help but load up. It’s a great company with a great business model that the market is depressed on. I can’t help but say thanks, and buy more shares. I hope that we see some more depression, as I would like to make this position bigger.

In terms of ASML, it is a bit out of character for me. I think it’s a fantastic business, with even more fabolous products than how it is as a business. However, I tend to shy away from technology. The possibility of disruption, the uncertainty of returns on investments and the pace the industry tends to move in all make for a hard hold. With ASML, I believe there is arguments to be made that they hold such a strong position in their markets that if one is willing to look through the bumpy ride, the returns over time will work out rather smoothly.

I think it’s quite visible when looking at yearly NOPAT growth over a longer period of time, and juxtapositioning it with the quarterly system sales. The longer NOPAT trend is up and to the right, whilst the quarterly system sales trend is quite bumpy.

If you like this graph, consider supporting this publication by buying a subscription through my affiliate link and get 15% at the same time:

Earnings summaries

As I mentioned, I won’t go into much detail, but I want to give some brief commentary on the earnings reports that have happened.

Constellation Software delivered pretty good results. There seems to be some FCF headwinds in the near future, but I think the important thing to focus on is the fact CSUs cash balance has grown is something that might hold promise for a larger deal approaching. Let’s see, the deployment rate has been pretty good for 2024.

SanLorenzo also reported earnings. The luxury sector, and naturally also the luxury yachting business has had a stock-wise slow year. I have around 19% of my portfolio in this sector, with SL being the largest position. In the running up to Q3 results, the stock has been trading down over a longer period of time. This is absolutely out of sync with other signals.

The company has been buying back shares for the last month or so, and recently we also saw Massimo Perotti start buying more shares for himself. The Chairman of the board already owned around 54.4% of shares outstanding, it’s not like he needs more shares. Perotti has bought shares for around €3.2mln and the company has bought back shares at around €3.05mln. This is the largest amount of shares bought by Perotti. The consensus forward multiples for the company at around €31 a share is:

EV/Sales: 1x (discount of ~25% to the average since IPO)

EV/EBIT 7x (discount of ~36% to the average since IPO)

P/E: 9.8x (discount of ~41% to the average since IPO)

With the company currently yielding at around 3.2% with last years dividends we now have a yield-play, multiple-play, and a slow-and-steady-play on our hands.

Now, the rational investor would look at my above writing and think: There is clearly troubles at SanLorenzo. The luxury sector has shown weakness amongst many individual companies, with consumers spending less on their highly priced goods. This is not the case for SanLorenzo.

First of all, the results leading up to Q3 has been driven by a good and steady growth:

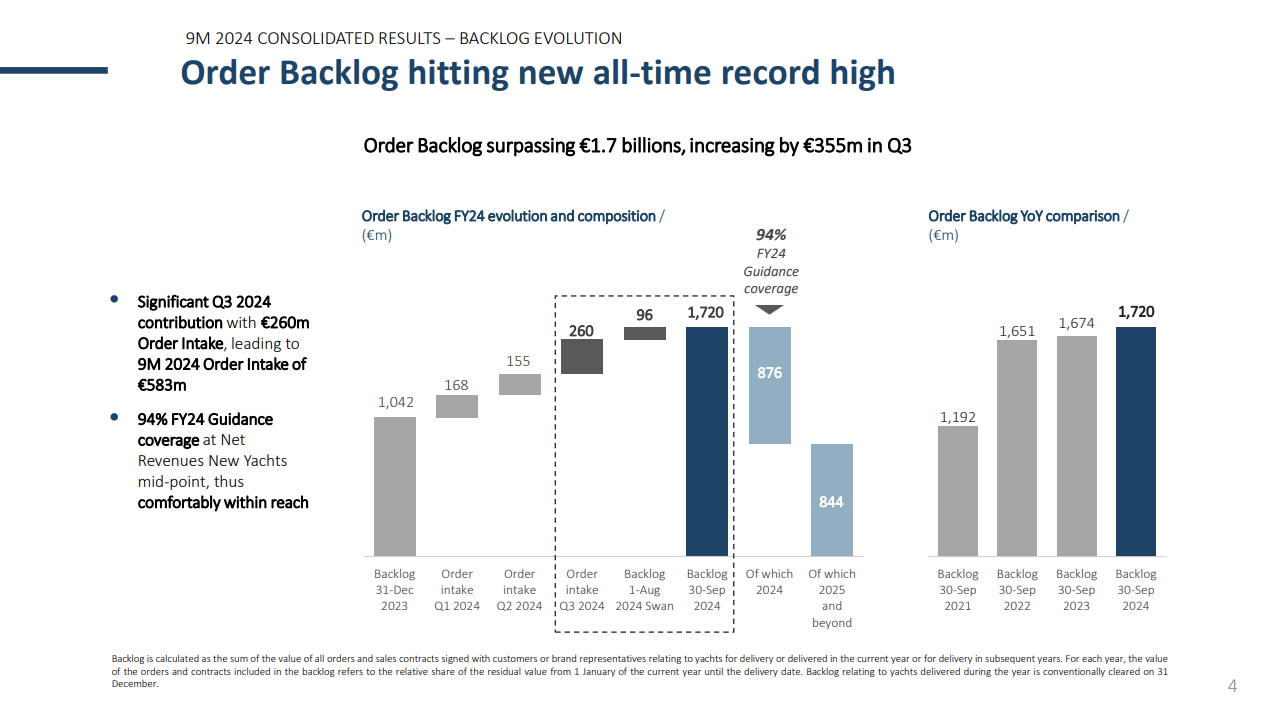

But, maybe the trouble lies ahead of us? Well, SanLorenzo are reporting new ordre-backlog records (helped by the Swan acquisition):

So - we can observe that:

The people who know the company best are buying shares at record levels

The company is growing as expected, despite most other sector-aligned companies are struggling

The future is looking as good as ever, if not even better than it ever has

The acquistion of Swan is also looking to be going at full steam, and has not only been quantitatively better than expected, but seems to be a culturally and product-wise great fit for the SanLorenzo group

What can be the cause of Mr. Markets pessimism then? Well, I suspect that SanLorenzo are dragged down by a triple-sentiment-whammy: 1. European equities are performing poorly and are out of flavour, 2. the luxury sector is struggling en-masse and doom and gloom has occupied headlines, 3. small caps are also underperforming compared to large caps.

None of these worries have materialized in the actual day-to-day operation of SanLorenzo. Right now, nobody talks about luxury yacht-makers. Why would they? They can either be (mis)understood as cyclical shipbuilders struggling in an eternally negative business, or a small and niche player in a disliked luxury sector. Thankfully, this gives the contrarian and rational investor a great opportunity. As Howard Marks put it in “The Most Important Thing”:

I plan to add to my SanLorenzo position when my December salary ticks into my account, some bargains are to good to not pick up.

Well, it seems I am quite bad at “not writing about quarterly results” - but I tell myself that this is not a summary of a set of results, rather a diagnosis (or honestly, rant) on market sentiments.

What I’ve read and listened to this month:

A great article on understanding the nuances of earnings. All earnings are not created equally:

Another very interesting article discussing how to say no to potential investments:

Great rundown on a niche industrial player on the Norwegian stock exchange:

A very interesting interview with the ever eloquent Dev Kantesaria:

A great discussion on Constellation Software:

This extremely interesting discussion with Nick Howley from Transdigm on 50x - there’s several long episodes where you get to listen to one of the best owner-operators talk about how they achieved their remarkable results:

That was it for this months summary. If you found this interesting, there are several ways you can let me know:

Leave a comment - I would love to hear feedback from anyone who reads this and has thoughts. Discussing and sharing is how we grow!

Subcribe for future updates, or share with friends.

Buy a Finchat subscription through my affiliate link for a discount.

As always, I drink a lot of coffee when I write these pieces, so feel free to chip in with a cup of coffee through the below link:

As always: None of this should be understood as investment advice. I am a hobby investor, with no professional training. I may sell or buy stocks without disclosing it at once, so you should not be following me. Do your own research, or you are bound to lose conviction when convicition matters.

Thanks for sharing this.

Do you have any reading recommendations to learn more about sanlorenzo?