Interesting insights - October 2024

Dear readers,

With October come the many waves of Q3 reports. This is the time of the year where the company in which we own small parts of get to celebrate by saying “We did it!”, or letting us down by admiting defeat in the short term. What I am talking about is guidance, or the art of trying to predict the future. It is a tough one, and an excercise neither analysts or company operators are particularly good at. This often makes for a turbulent time in the markets, as companies deliver as expected or not.

Personally, I think a lot of this share price ebb and flow is not something investors should put to much weight on. Yes, it is definitely important to pay attention to earnings and whether or not the company is selling it’s products as expected. But as a shareholder in excellent companies that have a market-leading position in their niches, I try to pay most attention to the long term fundamentals. So if some of my companies are “underperforming” in the quarter, I want to rather focus on what is actually happening, the sources of this underperformance, and the management’s rationale for not delivering as the analysts are expecting.

Let’s never forget that analysts, despite fancy Excel models and full-time jobs thinking and meditating over the future, have as little ability to know what is going to happen in the future as we do. That does not mean that they are tricksters or fraudsters, just that they have an impossible task in their work of forecasting the futures.

I really like a thing Jeff Bezos replied when asked about how he felt when he got congratulations on quarterly results from analysts (quote from 2017):

Those quarterly results were fully baked three years ago. So today I'm working on a quarter that will happen in 2020, not next quarter. Next quarter is done already and it's probably been done for a couple years.

And that’s most likely what most managers of excellent businesses are thinking about. Not how to deliver in December, but what they can do to make sure their business is so much better in ‘27, ‘28 or even further out. As I aim to be a long term owner of shares in great businesses, that’s how I should try to think about these results as well.

I’m sure you are now thinking: “Oh, he must have had some awful results this quarter to be so focused on the long-term”. Well, I’ll give a brief rundown of the results of all the companies in my portfolio that have reported.

In terms of content, it’s been a productive month for me. I have published four articles, two on pompous thoughts on investing: case for quality growth, investment strategy. Two articles on companies: this guest translation of a segment analysis of Norbits connectivity business and this one about electrification and industrial plays to gain from the mega-trend.

I also got to join the StockUp-podcast for a talk about my philosophy and investing in general. It’s tough having to talk about investing and companies without the luxury of getting to rewrite and edit a text before publishing. Great fun nonetheless!

Here’s the podcast episode:

Portfolio news

It’s been a month of some activity for me. In the article I wrote about electrification and niche producers of critical components I ended with saying I have added AQ Group and NCAB Group to my portfolio. Rather quickly afterwards, I sold NCAB Group again. I decided to do this because I needed the cash for buying more Evolution AB which dipped aggressively into their Q3 report. As I discussed in the thematic analysis, I thought that NCAB wasn’t that big of a deal right now, so I don’t mind monitoring it for a little while more.

I also went a bit back and forth in regards to Kinsale Capital Group. This E&S niche insurer has been a good hit for me since April. Following my decision to sell MercadoLibre, I have been looking at Kinsale. They are one of the more aggressive growers in my portfolio, and I have become more focused in my strategy. My aim is to own two bags of companies: Larger, slow and steady compounders positioned within niches, and smaller companies that can post better growth results over time. Kinsale was caught a bit in the middle. It was growing like my small companies, but sized to large. I also want to remain focused on risks. Inherent in insurance is a ton of unknowable risks, and exposure to financial black swan events (to a larger degree than the average stock). I therefore made the decision to sell Kinsale.

I don’t want to own companies within the financial sector any more, adding them to the basket of things I want to avoid alongside biotechnology and very cyclical businesses. Fundamentally, I still think of Kinsale as a great company to own, and I wish all the investors the best.

In Kinsales stead, I have invested in two new companies and, at the same time, added a new theme: Healthcare. I have added Omda AS and Medistim ASA to my portfolio. These are two Norwegian healthcare companies with quite different business models. Omda is a VMS serial acquirer of healthcare software aimed at larger public clients. Medistim is a seller and developer of ultrasound and imaging technology for cardiac and vascular surgeries and treatment. I think these companies add an extra interesting dimension to my portfolio, with unrelated revenue streams than all of my other companies. Both have had some troubles in the last two-three years, but I think the skies are looking brighter going forward. I’m working on deep dives of both Omda and Medistim as we speak and looking to publish them before the year ends.

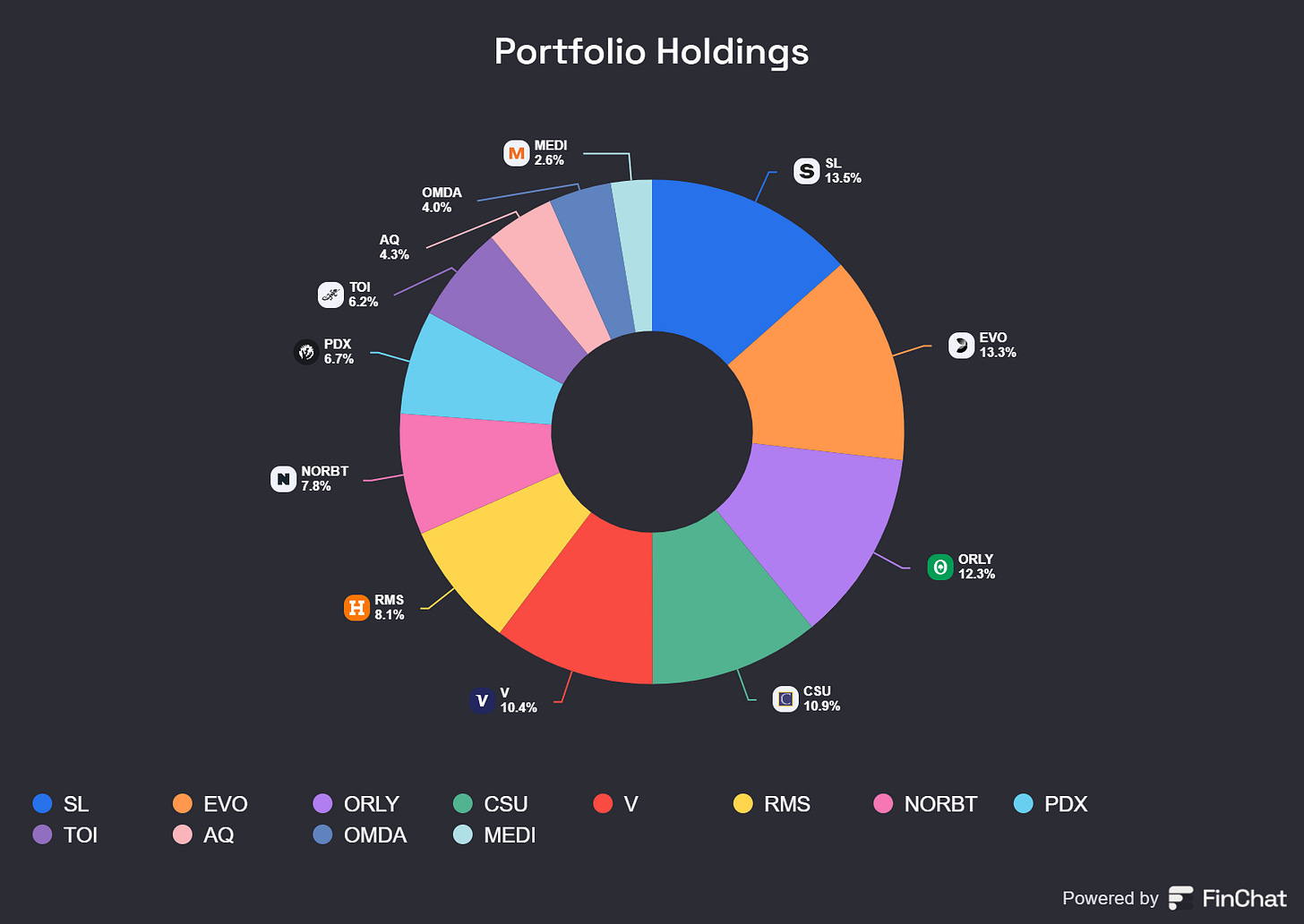

That means that when exiting October, my portfolio looks as such:

Q3: Reporting boog-a-loo.

I have had six companies reporting their quarterly earnings this month. I will therefore not spend to much time on each company, but at the ones I feel are most contentious I’ll spend some more time. Let’s dig in!

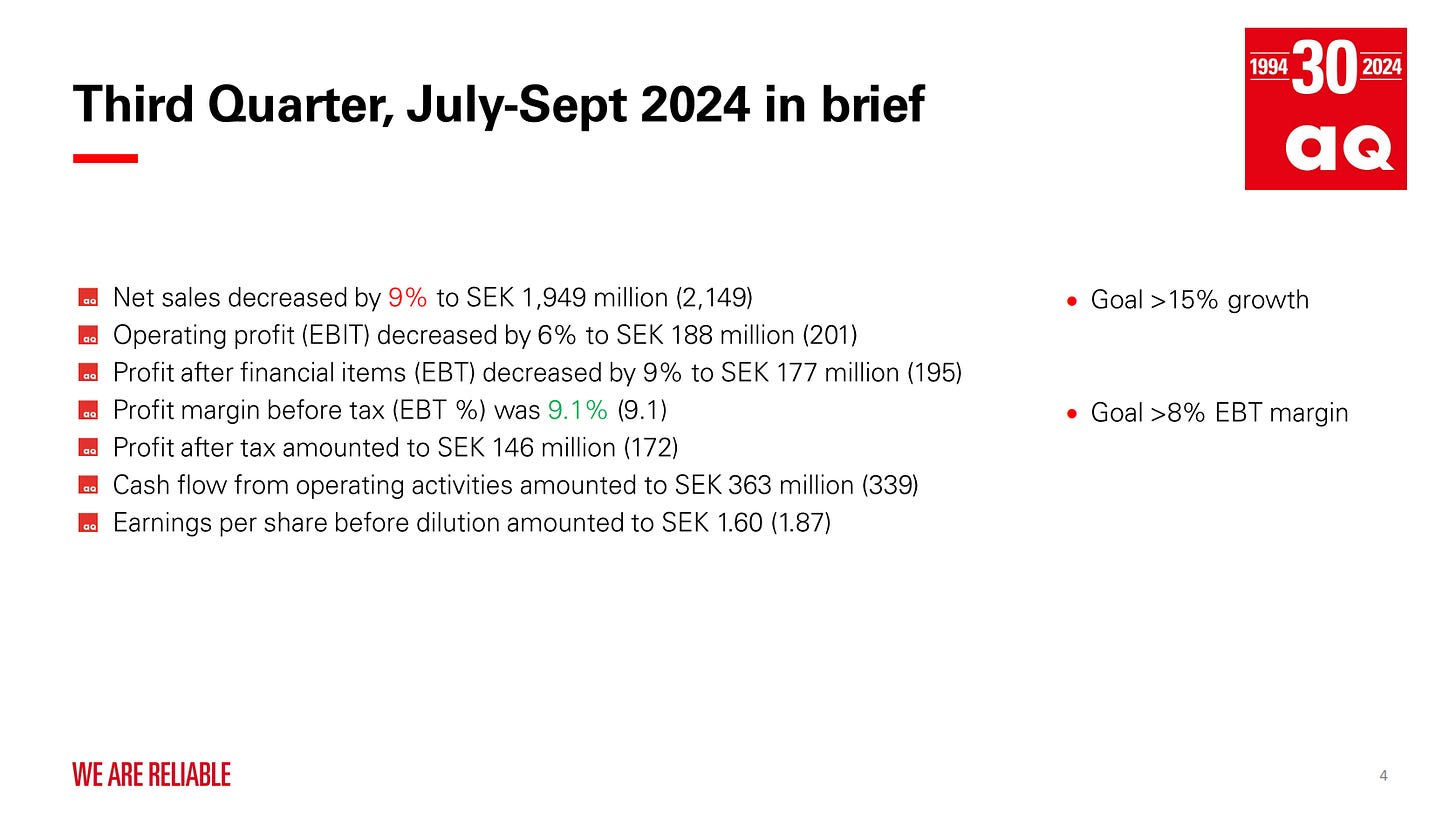

AQ Group

The first company to report it’s Q3 numbers were AQ Group, who released their earnings 17. October.

The numbers are showing that the EMS sector is experiencing some significant headwinds currently.

We can see that sales are down 9%, and EPS is down 14.4% YoY. This isn’t the best results. But they are holding up a lot better than peers, and to take one example: Kitron posted a 34% sales decline YoY.

I think the managements comments on this challenging macro-climate brings light to why I believe AQ Group is of higher quality than their competitors:

I think our cost control is really good, and it shows how our decentralized model works… As you can see we are quite used to this, and this is normal business for AQ. We are scaling up very fast, but also scaling down fast when we need to.

As AQ Group is an acquirer of factories and technical businesses, they also shed some light on their M&A activity going forward.

We can see that their acquired growth is increasing. Again, I will leave the floor to AQ Groups CEO James Ahrgren for some interesting commentary:

I can say price level and competition for the acquisitions we are looking for is much lower now than it was in 2021 when everybody was buying everything. So it is a nice situation to be in. We have a history of buying a lot of things when markets are bad, and we like to be contrarian.

Combine this with the fact that Ahrgren labeled their balance sheet as “extremely strong” (rightfully so as AQ Group has been deleveraging the last year or so) and that they already have acquired five factories and one engineering office I think the outlook for AQ Group is as strong as ever.

Evolution AB

My second or biggest position reported earnings on 24. October. This report had the theme of retail versus institutions, as short position was at record levels on the day before presenting results with few institutional owners and quite a lot of retail owners.

The report was pretty much in line with what I expected. Good EBITDA margins, some lower profit margins and good growth in revenues. EPS growth slowed down when adjusting for the one-off effect of the reduced earn-out liability, and we saw EPS increase by around 2-3%. We even saw RNG grow quite well, at 8.5% YoY.

Given that this year’s headlines have been a significant strike in their biggest studio, a doubling of taxes, and scares in regards to black markets in Asia the underlying development of Evolution business seems to be steady-as-she-goes.

As there are quite a lot of great coverage on Evolution, I want to highlight those who understand the business the best and not spend to much of my readers time covering this highly talked about company.

But I want to point out what I think are the most qualitative factor: They are really digging their moats in USA. They are re-entering the U.S. markets with Ezugi, which signals that they now have a plan B for dominance in the american markets. Add in that they acquired Galaxy Gaming earlier this year, which has licensing in most states, and now Evolution AB has three inroads to the enormous American markets.

This gets even rosier when we note that DraftKings closed their live casino studio because they can’t get it up and profitably running. Some years ago, the European operators tried to do the same but ended up giving up, just like DraftKings did now.

There is some very valid concerns about profitability in the american markets. Given that you need operations in each legislational area, scale will take time. I, however, think that Evolution cannot let this growth opportunity go. It might take time, but I am very much convinced that we will sow the seeds that are being planted.

It also helps that they are expanding globally. Planning to open their first Asian studio in the Philippines, and opening a studio in Colombia. Chugging along.

In wrapping up I want to remind my readers about the most important metrics for Evolution: Adding tables and employees so that more people can play Evolution games. We quite clearly see the effect of downsizing the Georgia studios in the employee count. I am sure this will be mitigated.

O’Reilly Automotive

O’Reilly continues to be an excellent compounder in both good and bad markets. Q3 was another quarter where management showed their conservatism, and they gave some slight downwards revision on their forward guidance. This is the hallmark of ORLY management: Underpromise, overdeliver.

Quick number rundown shows that the consumer is not having a great time, and we got a slow growth quarter after some strong comparable results last year.

Revenue: $4.36 billion (up 4% from Q3 2023)

Diluted earnings per share: $11.41 (up 6% from $10.72)

Operating margin: 20.5% (down from 21.3%)

Gross profit margin: 51.6% (slightly up from 51.4%)

Comparable store sales growth: 1.5% (below expectations, compared to 8.7% in Q3 2023)

Business Operations:

Total store count: 6,291 stores across US, Puerto Rico, Mexico, and Canada

Added 47 new stores in Q3 (35 US, 9 Mexico, 3 Canada)

Professional business showed strong growth and market share gains. This is particularly good to see, as professional services is a more sticky part of the market, and are a great segment to be positioned in.

Management commented on facing "broad-based consumer pressures and soft demand", especially in the DIY segments.

They bought back shares for 541mln (amounting to 0.5mln shares) in Q3. Pretty good tempo on the buybacks given that the shareprice have been above $1 000 the whole quarter.

They posted softer guidance for FY2024:

Comparable store sales growth: Lowered to 2.0-3.0% (from previous 2.0-4.0%)

Total revenue: $16.6-16.8 billion

New store openings: 190-200

Diluted EPS: $40.60-41.10

Operating margin: 19.4-19.9%

Despite the challenging environment, management expressed confidence in their market position and long-term industry drivers. I believe we’ll see a reacceleration in 2025 and that O’Reilly will continue to take market share from weakening competitors such as AAP.

Always good to remind my readers about the pretty insane amounts of FCF going into share buybacks at O’Reilly:

Visa

As usual, the blue and yellow card company posted some very solid results. Comparing Visa and Mastercard results also makes me suspect that Visa is gaining speed in regards to market share, and is possibly capturing some share from Mastercard. Hard to know, as these two names are very much in line with each other.

I think the slower growth in Visa is very much compensated by a lower multiple, and I struggle to see that either the quality or growth in Mastercard is anywhere near far better in MA than Visa.

Growth is driven by several things:

Core Business Growth:

"Relatively stable growth" in three key metrics:

Payments volume (8% growth)

Cross-border volume (13% growth)

Processed transactions (10% growth)

New Business Areas:

"Strong momentum" in two strategic areas:

New flows

Value-added services

CEO McInerney expressed optimism about future growth opportunities, stating:

We see tremendous opportunity ahead to grow our business, deliver for our clients, and collectively shape the future of commerce.

Paradox Interactive

The month ended with two of the companies I’m invested in that have a lizard in their logo reporting their earnings.

Q3 is uneventful for Paradox Interactive. As August is not a month where people sit inside and play a lot of games, there’s not a lot launches.

Financial Performance Q3 2024:

Revenue: 434.0 MSEK (up 2% YoY)

Operating profit: 142.8 MSEK (up 67% YoY)

Main revenue drivers: Cities: Skylines, Cities: Skylines II, Crusader Kings III, Hearts of Iron IV and Stellaris

Adjusted EPS was up 73%(!): 1.13 (0.66 Q3’23)

I am happy to see that Cities Skylines II is picking up steam, and players are more satisfied with the game. It’s going to create an additional platform of earnings through release of great DLCs.

Paradox further gave some color on their strategic Focus:

Paradox is continuing their focus on their core business: Grand Strategy and Management Games

They're making "bigger investments" in these core areas.

Lower risk experimentation is being done through Paradox Arc platform. They have currently reduced the amount of personnel working on Arc projects. This means that they’re currently working mostly on established names.

Pipeline Commentary:

Wester mentioned they have "an exciting pipeline"

They talked about having around 8 games in development currently

Wester promised to "present more later" regarding the pipeline

Paradox is feeling what everyone else in the game development business is feeling: Games are taking longer to make.

So a bit of a dudd of a quarter, but 2025 is looking brighter and brighter, with easing comps and probably some big releases.

Topicus

My second and last lizard company posted some decent results. They’re showing some great results. FCFA2S, Mark Leonards favourite metric is up +60% YoY.

Topicus continues to acquire companies in a pace that is a bit slower than what I’d hope for. As we see from the below summary the cash position has been building lately.

Key Financial Highlights:

Revenue Growth:

Q3 2024: €312.2M vs Q3 2023: €278.8M (12% growth)

YTD 2024: €930.0M vs YTD 2023: €815.3M (14% growth)

Net Income Growth:

Q3 2024: €38.0M vs Q3 2023: €28.3M (34% growth)

YTD 2024: €93.3M vs YTD 2023: €72.9M (28% growth)

Cash Position:

Cash balance as of Sept 30, 2024: €234.6M vs Dec 31, 2023: €179.1M

Acquisition Activity:

YTD 2024 Acquisitions:

Total consideration of €97.6M for acquisitions completed during first 9 months

Comprised of:

Cash consideration: €65.1M

Cash holdbacks: €22.0M

Contingent consideration: €10.6M

Post Q3 2024 Commitments (Subsequent Events):

Additional acquisitions pending/completed after Sept 30, 2024

Total consideration of €50.0M, consisting of:

Cash consideration: €43.5M

Cash holdbacks: €4.5M

Contingent consideration: €2.0M

The acquisitions span various verticals, including facility management, library, logistics, healthcare, human resources, IT, financial services, retail management, data security, gaming, automotive, public sector, and manufacturing.

Hermés Paris

Hermes also reported their earnings 24.10.2024. The luxury company showed that they’re in a different class than the rest of the luxury segment. We also see that they are investing well into the business, and this is something that Hermes tend to do in tough times for the luxury segment.

Financial Performance:

Revenue reached €11.2 billion at end of September 2024, up 14% at constant exchange rates (11% at current rates)

Q3 2024 sales were €3.7 billion, up 11% at constant exchange rates

All geographical regions showed growth despite uncertain economic conditions

Regional Performance:

Asia ex. Japan: +7% growth, strong in Korea, Singapore, Australia, Thailand

Japan: Strong +23% growth with excellent Q3 performance. Driven by Chinese consumers using the currency volatility in their favour

Americas: +13% growth, maintaining solid momentum

Europe excluding France: +18% growth with strong local demand and tourism

France: +14% growth despite slight Olympic Games-related slowdown

Business Segments:

Leather Goods & Saddlery: +17% growth

Ready-to-wear & Accessories: +15% growth

Silk & Textiles: +2% growth

Perfume & Beauty: +7% growth

Watches: -6% decline due to high comparison base

Other sectors (Jewelry & Home): +17% growth

We see that Hermes’ core categories grow well, and that even perfumes and beauty is up. This is typically a more cyclical segment

Key Developments:

Opened new leather goods workshop in Riom, France (23rd workshop)

Launched new women's perfume "Barénia"

Continued store renovations and expansions globally

Outlook:

Company maintains confident outlook despite complex economic and geopolitical context and restated their revenue growth goals at constant exchange rates for medium-term. I like this as their growth goals are quite ambitious compared to adjacent companies.

What I’ve read and listened to this month:

I’ll keep this short and sweet, as there’s quite some text in this article.

I love this episode from

, discussing with the Twitter-persona behind the account of Sidecar investing. Aligning ourselves with excellent operators and trusting in management is important things to remember as investors, and I warmly recommend this episode:This podcast from The Investors Podcast is a great way to learn about Bessembinders research on what drives shareholder returns. It’s one of the main sources of inspiration for my investment approach:

The number one resource on Evolution is

over at Do Not Distribute. Must read for any Evolution investor:A great rundown of many excellent companies: