Introduction

In this article, I will outline my research and understanding of a potential gem that I aim to hold for a long time. Serial acquirers are a theme I’ve been greatly interested in since starting my writing. I think these businesses have an excellent combination of things:

They can grow at a very healthy pace for a very long time (mid-double digits)

They provide downside protection through counter-cyclical growth mechanisms (in good times their business grows, in bad times they can up in-organic growth by buying more companies)

The issue is that these businesses are very recognised for these dynamics, leading markets to price them beyond perfection. Oftentimes, even these highly valued companies (Lagercrantz, Lifco, Constellation and so on), can still provide investors with great long-term compounding opportunities because markets underestimate their staying power, and have a too short time horizon for their models and investments.

But, in the very rare occasion where you can dig out the not-so-much-talked-about serial acquirer, where you see a viable path for long-term compounding, you have yourself a gem.

The company I’m going to discuss today might be one such gem: Momentum Industrial (MMGR-B.ST).

However, I want to note that this is not like finding Terravest in 2023, Constellation in 2016 or Lifco in its relisting in 2014. Despite my quite bullish introduction, I think Momentum Group is a bit more discovered, and therefore, highly priced than those examples. However, with only 5% of the market captured, and an ever-expanding base of companies it can acquire, integrate and improve, I have made Momentum Group a cornerstone in my portfolio.

Here is a quick overview of the company at a metric level based on my investment pillars:

Ability to reinvest well into business growth: Average ROCE: 25%, ROIIC of ~29%.✅

Competitive advantages: Yes - the biggest operator in a fragmented but important aftermarket for the strong Nordic industry.✅

Fundamental growth: Growing operational earnings by ~30% since listing and posting ~20% CAGR throughout the financial crisis✅

Skilled management aligned with investors: Management is aligned through both stakes of ownership and incentives.✅

Manageable debt: Equity/Asset ratio: 33% ✅

Before we dive in, I want to note my appreciation and thanks to Req Capital for their writing on Momentum Group. It has been a source of inspiration and help in writing this article, and I’ve borrowed a lot from their annual letter (linked below). Go check them and their funds out if you are an investor based in the Nordics (I am not a partner or affiliated with REQ in any way, I just think they do a damn good job and deserve more attention).

Company Introduction

One of the key qualities I look for in companies that I want to invest in is longevity. Momentum Group AB is a rather new name on the stock exchanges. Having found its true form and listed as a solo entity in March 2022 (31. to be exact) this Swedish acquirer operating within the niches of industrial niche and components is not a company people would think of as old.

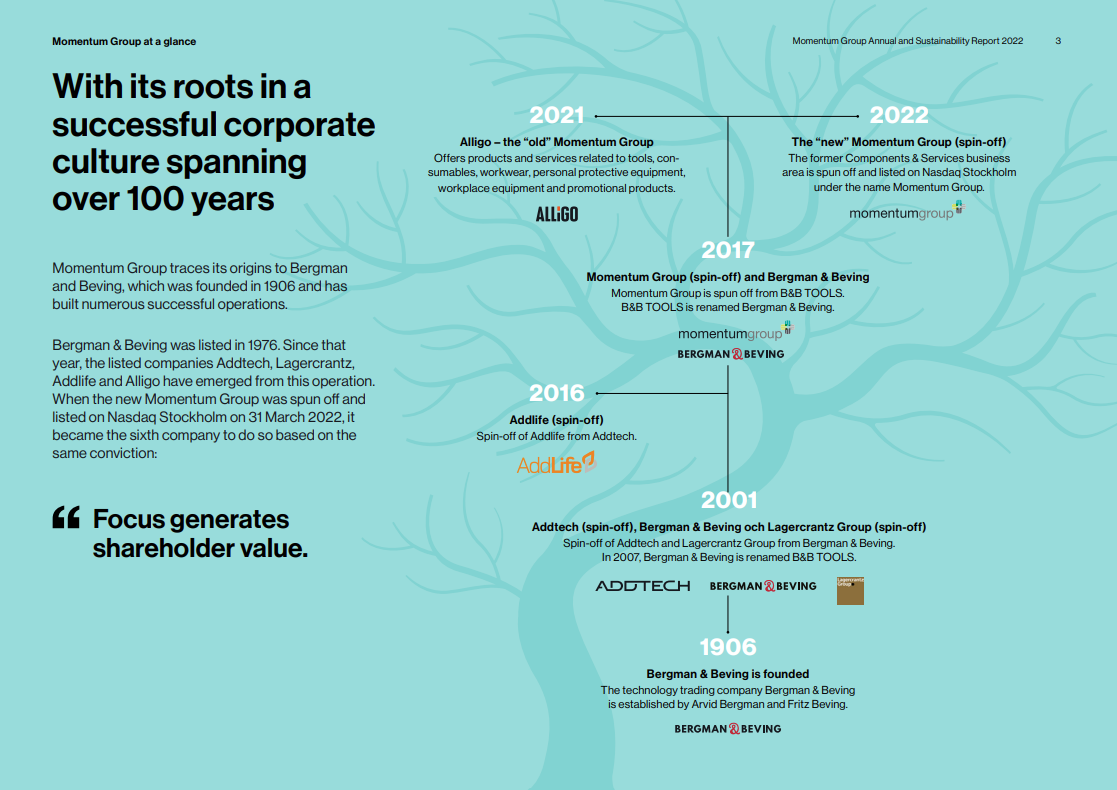

But Momentum Group have their roots in the Bergmann & Beving family. This (in my opinion) legendary collection of great businesses traces its lineage back to the Swedish/German duo of Arvid Bergman and Fritz Beving which founded B&B in 1906. This should be a familiar name for any investor interested in serial acquirers.

The success story of Bergman & Beving is nothing but extremely impressive. The key components have been thematically simple, but difficult to execute disciplined:

Focus on profitability at (sub-)company level through their internal profitability target (+45% EBITA/WC, more on this in a second)

Decentralisation as the ethos of the business

Niche industries provide sticky growth and cash flows that can be leveraged with great effect through acquisitions

This is supposed to be a write-up on why I own Momentum Group, but I ask the reader to bear with me a bit more before we move away from B&B - it’s an important piece of the puzzle.

Bergman & Beving found its current acquisition-driven growth dynamic under the lead of Anders Börjesson who entered B&Bs management in 1979 and has been credited with the introduction of the EBITA/WC +45% metric, aimed at creating a capital-light business. Under Börjesson B&B delivered a total shareholder return of 25% annually from ‘79 to 2001 and engineered the split of B&B into three separate entities (AddTech and Lagercrantz being the two others).

This family of serial acquirers have had nothing but spectacular success over many stages. Since spinning off Addtech and Lagercrantz the companies have delivered 27.1% and 22.3% annual shareholder returns and they continue to post great results year in and year out. If we see this in a collected manner we can see the impressive results from the B&B family:

Spin me right round baby right round

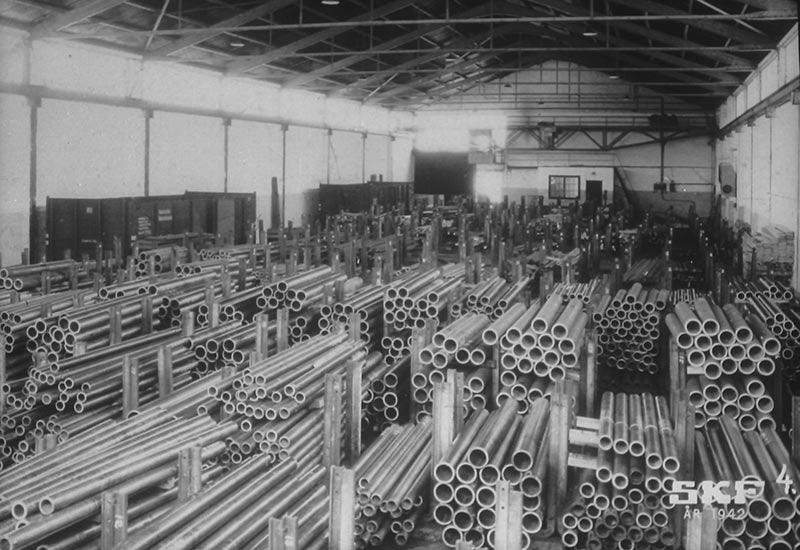

With this impressive backdrop, we’ve set the stage to explain why I think Momentum Group is an interesting case. The origins of the company go back almost 100 years to 1929 as the distribution branch of Svenska Kullagerfabriken (SKF).

Momentum Industrial was founded as a formal entity in 1997. The true story of this newest branch of the Bergman & Beving family tree began in 2004 when it was announced that B&B had acquired Momentum Industrial from SKF. At that time, Momentum represented around 1% of SKF's annual sales. B&B acquired Momentum Group for SEK219 million, and it has since become one of B&B's best acquisitions, growing from the price of SEK219 million to a market cap of around 9 billion SEK.

Although Momentum Group is a new entity on the stock exchanges, its core is Momentum Industrial. This core has been operating as a distributor of niche parts to the industrial sector in Sweden and, later, the Nordics for almost 100 years.

Despite having operated through two world wars, rapid global modernization and several economic crises: Momentum Industrial is still posting strong results. In their accounting, Momentum Group has Momentum Industrial under their Industry sub-segment, which also contains some servicing. Momentum Industries provides around 92% of the revenue of this segment, and for the rolling 12 months, this core holding provided a revenue of 1.58 BSEK.

For the last R12 months, Momentum Industries represented 56.4% of all revenues. In their first listed year, however, Momentum Industries represented around 68% of the the group's total revenues. So, we see that they’re rather rapidly moving toward having more of their companies contribute meaningfully to revenue generation.

Why am I focusing so much on this part? Well, I think it’s important to highlight the sheer staying power of the group's core, which indicates that the companies Momentum Group is acquiring probably share the same qualities.

When you can buy companies for 5-7x EBITA, and let these businesses grow with their steady pace, leveraging their reliable cash flows into new in-organic growth creates a long-lasting snowball of compounding that is a joy to align ourselves with as shareholders.

This is the beautiful simplicity of the B&B legacy that Momentum Group is spearheading: 1. Ensure every company is “sweeping their own front porch” when it comes to profitability (profitability supergoal of EBITA/WC +45%), 2. let the people who are closest to the customer ensure great products and services, and 3. leverage experiences and learnings throughout the many smaller units in the group.

As you can see from the above illustration provided by Momentum Group, there’s more to this story. Thankfully Req Capital has provided an excellent run-through of the history of Momentum Group in the fund’s annual letter 2024, and I’ll provide a quick overview of recent events now.

Recent history

Bergman & Beving renamed itself B&B Tools in 2007, and Ulf Lillius served as the CEO of TOOLS Momentum (i.e., Momentum Industrial). At this time, B&B experimented with vertical integration and centralisation, trying to gain value and growth from scale advantages. This is not an inherently bad idea, but it did not work out well. Throughout this period, Momentum mostly grew organically, as the focus was not on inorganic growth but on creating stable cash flows that could be reinvested at the B&B level.

Lillius took the helm at B&B Tools in 2012 and started working on bringing B&B back to its decentralised roots. He split the various parts of B&B TOOLS into separate entities in 2017 and took over the newly formed Momentum Group. At this time, Momentum Group was both the parts business and the wear business, or as described by the company itself: The machines (Momentum) and the people (Alligo) business.

Speeding things up, in 2022 Momentum Group got its current company form (and listed 31. march of 2022). Alligo continued to be a company selling personal tools, equipment and workwear (and much more). The aim was to make the value of the components and services businesses more visible to shareholders. The business of selling workwear and tools compared to parts and services for industrial customers is quite different and management and ownership felt like the companies’ individual strengths got muddled together in the joint group.

I think this brief history tells us two things:

It’s been a long way coming to get Momentum Group’s longevity and counter-cyclical qualities in an independent form to showcase its strength.

Ulf Lillius spearheaded this and is now at the place he has been working to come to since (probably) taking over the helm at B&B Tools 13 years ago.

More recently, Momentum Group further enhanced their business structure. They divided their business areas into two: Industry and Infrastructure. The industry area is mainly Momentum Industries, and the infrastructure is a newer business area. The industrial businesses tend to have higher margins than the infrastructure business area. This move is mostly to create clarity for shareholders when discussing earnings and initiatives.

Creating win-win situations - Niche distributors

I first gained a true appreciation for distributors within niches through learning more about O’Reilly Automotive (one of my core holdings) and through learning from Fastenals’ story. Industrial niche distribution is a fertile ground for compounding, as is demonstrated by Diploma PLC (and quite frankly, Momentum Industrial).

Industrial niche distributors have several key elements working in their favour:

They are capital-light compared to producers, as they don’t need factories to make all the valves, gears, and shifts.

By offering a wide selection of the best products available, distributors provide value far above what it costs to buy their products. This is doubly effective when the distributor's employees are experts in their field.

Individually, each part only represents very small absolute dollar-costs of the customers’ cost-structure. If you need a small sealing which costs 200SEK to get the 1-2mln SEK equipment working, price isn’t what matters: It’s availability, speed in delivery and getting the machine running again as fast as possible.

As long as industrial production continues, parts will need to be replaced. When cycles turn bad, the need for repairs and maintenance becomes more important as customers become more conservative and defensive.

CEO Ulf Lillius talks about this quite often in the presentations, where he says that the focus they have is on generating sales and profit through adding value to their customers. What I loosely translate this to is that: By buying from the Groups companies, customers end up getting more than what they paid for. Momentum Group earn some, customers earn some. Win-win.

Momentum Group illustrates this quite well in their annual reports, and I’ve attached three stories highlighting the sheer value that Momentum Group provides to their customers through their offering of parts and expertise:

Proving itself in times of trouble

This dynamic of generating sales and profits through adding value to customers became apparent for Momentum Group in the financial crisis of 2006-2008. Whilst the company was under the helm of B&B Tools (the renamed Bergman & Beving), Momentum Industrial showed their resilience.

As Momentum Industrial was a sub-part of B&B, I can’t find details on margin and such, but let’s glance at how the growth lasted through one of the biggest shocks in recent financial history:

In 2006/2007, Momentum Industrial increased its operating revenue from 44mln to 50mln year-over-year (+13,64%). In 2007/2008, the company posted operational earnings of 55mln (+10%). In the final throes of the financial crisis, in 2008/2009, the company grew its operational earnings to 88mln (+60%!), representing an impressive 19.8% CAGR in operational earnings throughout the financial crisis.

These results are for Momentum Industrial standalone, and as a smaller entity. The focus of Momentum at these times was largely organic, and under the umbrella of B&B Tools, they did not work too hard to achieve acquisitional growth. I say this to remind myself and the reader that times have changed. But I believe parts and distribution to be a counter-cyclical business based on these common-sensical principles:

In tough times:

you need to save money

you’re hesitant to invest for growth

you turn conservative and preserve your stuff

So when your Momentum Group associate contacts you in tough times and says: “We have this gasket, which costs 0.1% of your industrial machine but increases output by 1% and increases its life span by 5%”, well talk about a great deal!

As I provided some examples from Momentum Groups 2022 report, it was interesting to see that providing value to customers has been a core tenet of Momentum Group (then Industrial) for basically forever. Here’s a story from them adding value to a milk producer from their 2006/2007 report:

Big fish in a small pond

I’ve often used the metaphor of being the biggest fish in smaller ponds in my writing. This is where industrial distributors can shine, and Momentum Group is one such case. They are effectively acquiring a school of these “kings of the pond.”

Why do I call them kings? Well, let’s look at the competitive advantages that Momentum Group has managed to build:

Extensive product offering

Collectively they have over 750,000 products, many priced under €5-10.

Includes seals, bearings, pumps, lubricants, bushings, gears, chains, and more.

Less than 0.1% of products overlap; only 5% of products sold annually are sold again within three years. Very few companies can have this large stock of components ready at any time.

Barriers to entry

High barriers due to fragmented customer and supplier base and vast product range.

Serves thousands of SMEs in Sweden that rely on machinery with critical spare parts that they need at a moment’s notice.

It doesn’t make sense for the makers of the products to set up their own shops, so Momentum’s distribution and stocking of a large array of items provide an essential and indespensibal service both for customers but also producers.

To sum it up: You’ll lose to Momentum if you can’t stock hundreds of thousands of parts and be able to move them as fast as absolutely possible.

Time and money savings for customers

Fast, reliable delivery is crucial as machine breakdowns can halt production. Availability and timely delivery matter more than price.

An extensive supplier network ensures the availability of replacement products.

Unique expertise in handling high SKU/low turnover logistics.

Value-Added Services & Customer Relationships

They do more than move and sell parts. The independent companies have a wide expertise on technical issues and solving equipment problems. I.e. answering: We have this unique problem, what is the solution and do you have the part to get our production running? Yes is usually Momentum’s answer.

Local knowledge & customer intimacy built over decades. Momentum puts a lot of weight on preserving this when it acquires companies.

Conducts 1,000+ customer improvements yearly, reducing costs, time, and environmental impact.

Strong pricing power due to the mission-critical nature of its products. If a customer has machinery that costs millions to own and operate, it matters very little if the part costs 100 or 500 SEK as long as the capital-intensive equipment gets running as fast as possible.

The beauty of this is that moving, selling and helping out customers with different industrial parts lends extremely well to a decentralised business model. It makes much more sense to have many smaller companies that are close to customers with a wide range of specific parts selection than having one centralised company with as many parts as possible.

And Momentum Group is honestly just getting started. They’ve come out of the starting block at running speed, adding around 65% of sales to their revenue since going independent. The Group is the largest parts distributor in Sweden, but still only holds a 5% market share in their oldest market, and in the other Nordic countries they hold no more than 2% of the market share. And as industrial production keeps modernizing new parts will surface. Momentum can continue to flow along this river of modernization, supplying new parts to new technological needs. I.e., we do not need to be too worried about robots taking Momentum Group’s market.

A glance at their offering and end-markets

In this section, I will give a brief overview of the products and end markets that Momentum Group offer parts to by showcasing some of their companies. At the time of writing, Momentum Group consists of 30 individual companies, and many of them have their own subsidiaries and sub-companies.

I’ll group this overview by their business segments, and provide one example company for each segment. The rest can be found here.

First, let’s start by introducing the various business divisions that are positioned within industrial and infrastructure.

Power Transmission

This division focuses on supplying components and systems for power transmission in industrial machinery. Products include gears, bearings, chains, and related spare parts that ensure smooth operation and minimize machine downtime. These offerings are critical for maintaining industrial productivity.

Specialist

The Specialist division provides niche expertise and products tailored to specific industrial applications. This includes advanced measurement technology, non-destructive testing, and material testing solutions.

Flow Technology

This segment covers components and systems for managing fluid flow in industrial processes. Products such as pumps, seals, and lubricants are essential for industries requiring precise control of liquids and gases in their operations.

Technical Solutions

The Technical Solutions division offers a wide range of services including maintenance, repair, and operational support for industrial equipment. This division ensures that customers' machinery remains operational with minimal disruptions through service workshops and tailored technical expertise.

Power Transmission Example – Momentum Industrial

Earnings: SEK 1,180 million annual turnovers, ~280 employees (taken directly from the webpage, not updated with R12 numbers it seems).

Market Focus: One of Sweden’s leading resellers of industrial components, providing local warehousing, consultancy, product training, condition monitoring, and logistics solutions.

Parts: Bearings, Transmissions, Motors and Gears, Pumps, Seals, Pneumatics, Linear Products (drives and such), Hydraulics, Lubricants & Chemical Products, Industrial Rubber.

Industries Served: Processing and manufacturing, including paper/pulp, sawmills, automotive, food, mining, and engineering.

Specialist – HNC Group

Earnings: SEK 65 million annual turnover, ~30 employees.

Market Focus: Provides industrial automation solutions in Denmark, selling and producing components, as well as custom automation and process optimization solutions.

Parts: UNIC, Pneumatics, Aluminum Profiles, Workbenches, Technology, Linear Technology, Electrical Panels

Industries Served: Food and pharmaceutical industries, machine builders.

Flow Technology – Askalon

Earnings: SEK 317 million annual turnover, ~115 employees.

Market Focus: Specializes in advanced valve solutions, particularly control valves, holding a unique market position as the exclusive Emerson representative.

Parts: Control valves, valve controllers, isolation and shutoff valves, pressure and safety relief valves, functional safety, regulators, actuators, VAG valves, damper valves, hygienic valves, bulk storage and transport, pressure/vacuum valves, instruments & accessories, steam traps & strainers, spare parts, desuperheaters, silencers, diffusers, steam conditioning stations, flow meters, electric lock device, hardware, software

Industries Served: Power, refinery, and process industries across Sweden, Denmark, Finland, and Iceland.

Technical Solutions – Rörick Elektriska Verkstad

Earnings: SEK 155 million annual turnover, ~70 employees.

Market Focus: Provides service, repairs, and conversions of electromechanical equipment.

Parts: Electric motors, generators, transmissions, pumps, industrial components.

Industries Served: Processing and manufacturing industries.

I recommend taking a peak behind the curtain to see just the sheer breadth of parts being provided by Momentum Groups sub-companies to see the many things they offer. A part of me wants to provide a picture of different gears, valves, tubes and so much more, but it would just end up looking like a messy toolbox.

Another important factor to take into account is that Momentum Group is focused on expanding their sales to attractive sectors, and has recently added into their portfolio companies that serve growing and attractive end-markets such as nuclear, renewable energy, automation data centres and so on. These sectors will continue to grow and provide a coherent base of earnings for the Group.

A common-sensical approach to profitability and independence

The Bergman & Beving family has employed the Profit-to-Working-Capital (P/WC) metric as a key financial measure to ensure capital efficiency and sustainable growth. Introduced in 1981 by Anders Børjesson, this metric prioritizes return on working capital rather than traditional measures like Return on Invested Capital (ROIC) or Return on Assets (ROA).

The P/WC metric is defined as EBITA divided by working capital (inventories, receivables, and payables), and its target is set at greater than 45%. Achieving this threshold ensures that a company generates sufficient returns to cover taxes, reinvest in growth, and distribute dividends without relying on external financing. When this target is achieved, the company is considered to be growing through a self-funded cycle.

The rationale behind using working capital as the denominator instead of invested capital lies in the nature of Bergman & Beving’s businesses, which focus on trading and distribution rather than asset-heavy operations.

Unlike industries that depend on significant fixed assets, Bergman & Beving’s model emphasizes efficient capital turnover. Working capital is a more relevant measure for these businesses, as their profitability is directly linked to how well they manage their inventories, receivables, and payables. By focusing on this metric, the company ensures that cash is not unnecessarily tied up in operations, thus increasing liquidity and financial flexibility. This target is highly relevant for Momentum Group and has been the foundation for their focus on profitability and growth throughout the group and is integrated in their decentralisation process as well as in management incentives.

Sweeping your own porch

A company achieving EBITA/WC greater than 45% is considered self-financing, meaning it generates enough internal cash flow to support its operations and growth initiatives without the need for debt or dilution. Originally, this target was set in a period of higher tax rates, ensuring that one-third of earnings would cover taxes, one-third would be reinvested into the business, and one-third would be returned to shareholders as dividends. This structure allows for steady, long-term growth at approximately 15% annually without diluting shareholder value or increasing financial leverage.

Optimizing EBITA/WC involves multiple financial levers, including improving pricing strategies, reducing costs, and efficiently managing working capital components. Companies can enhance their EBITA/WC ratio by accelerating receivables collections, extending supplier payment terms, and minimizing excess inventory. Small adjustments in these areas can significantly improve cash flow and overall business resilience. As an integral part of the onboarding process and taking a job at Momentum Group, the people of the companies get an introduction into this through an internal book called “Entrepreneurship to Achieve Increased Profitability - Objectives and Tools to Achieve P/WC > 45%" (talk about a sexy title that captures the eye).

The continuous improvement of working capital management creates a positive feedback loop that strengthens financial health and enables sustainable expansion. Companies that excel in managing their working capital effectively can reinvest their earnings into organic growth and acquisitions without incurring additional financial risk. This approach ensures long-term shareholder value creation while maintaining financial independence and operational stability. The P/WC goal remains a central strategic focus, guiding Bergman & Beving’s financial decision-making and business operations.

Culture and management

I believe some of the most compelling aspects of Momentum Group are their culture of value creation and forward-looking mindset and their key managers, Ulf Lillius (CEO) and Niklas Enmark (CFO). In this next part of the analysis, I’ll be discussing Momentum Groups decentralised business structure built on trust and responsibility.

Several great serial acquirers have shown the ability to operate with few key management employees working from leadership positions out of the company headquarters. Momentum Group is one of these. According to Req Capital, they usually just have three people working out of the head offices: CEO Ulf Lillius, CFO Niklas Enmark and head of IR Ann-Charlotte Svensson. This makes sense, as the company operates in a highly decentralized structure.

Decentralization is a trendy word, with companies tossing it around to show that they’re not wasting time and money on bureaucracy. I believe that decentralization has a couple of key tenets:

Ownership: This is both through actual ownership of parts of the companies, or ownership and agency as responsibility and incentives being placed on sub-company and their managements level rather than on the top management.

Responsibility: The sub-company management has the responsibility of achieving the profitability target of EBITA/WC >45%, after that they are free to decide how and when to grow. This fosters a positive cycle of agency.

Close to where things happen: By providing the people who are close to customers, employees and markets with ownership of decisions and responsibility for outcomes you get what consultants want to market as agility, but I prefer to think of it as more sound reaction time.

Momentum Group describes decentralisation within their Group as such:

At Momentum Group, decentralised responsibility is key to our success. The management team of each company has considerable freedom but also bears a responsibility to continue developing the company on their own. In practice, this means that our subsidiaries are driven by clear objectives with a high degree of independent decision-making and flexibility.

I found the part about decentralisation in the recent annual letter to be a very good read, and I recommend it to readers curious to learn more.

A closer look at the culture at Momentum Group

As mentioned, decentralization comes with a set of responsibilities. First of all, Momentum Group has a core ideology based on “sweeping your own porch”, i.e. achieving a profitability ratio of >45% EBITA/WC.

As long as the sub-company is achieving these goals, they are free to work towards bettering their companies as they best see fit through the local boards.

And this is where the Group comes in. Decentralization does not equal hands-off. Through the boards of the various local companies, Momentum Group has two or three representatives who have experience working within their business philosophy and other similarly shaped companies serving relevant markets. This creates a competency spider web, where best practices and experiences ripple throughout the organisation allowing for different companies with more or less similar business models to learn from the various practices within the operations of the 30 companies that make up the Group as a whole.

This approach is something that in particular Constellation Software has been efficient at using: Each company functions as a sort of laboratory to test out new theses’ or ways of doing things. So instead of gaining effects on a centralized basis (i.e. buying power, effects of scale, coordination efficiency bonuses and so on), serial acquirers can gain resiliency through many nodes of operations.

In addition to the board setup, Lillius and Enmark are often up and about, spending more time visiting the group companies instead of spending time managing HQ affairs. This ensures that they’re up to speed on what's going on, and that they’re available for discussions on acquisitions or business improvement to the many different holdings.

We see this true belief in decentralisation through how fast companies are allowed to start acquiring new companies into their own. Req Capital highlights that just four months after being acquired by Momentum Group, iTEMS did its own first acquisition company.

What this creates is that instead of solely relying on the HQ management to focus on using the group cash flow to acquire companies, Momentum Groups snowball rolls faster for each profitable company they add to the group. Not only does Momentum acquire the sticky cash flow of niche industrial parts distributors, but it also acquires the knowledge of the industrial landscape in which these companies operate. This creates a cultural dynamic that goes beyond just sticky cashflows and great reinvestment opportunities.

People are their greatest asset

For Momentum Group people and culture is the most important asset. This is often a cliche in business, but I find the way Momentum Group talk about these topics to have authenticity. In my research, I’ve found Momentum to be focused on two P’s: People and Profitability. I recently listened to a podcast about the VMS company Jack Henry (a provider of software to smaller and medium banks in the U.S.) and they had this lovely quote on why people matter:

If we take care of our people, they take care of our customers, who in turn takes care of our financials

There’s a lot of truth to this in business. As investors (or human beings in general) we’re primed to look for shortcuts and simple ways to look for signs of great businesses. I think that makes us want to invest in companies with rockstar CEOs (popularized through the book “The Outsiders” by William Thorndike). I’m also a fan of great operators, but I think it’s a bit too simplistic to expect a CEO to solve everything, which logically makes little sense, after all there are hundreds and thousands of employees in a lot of listed companies.

For Momentum Group the objective is to create a network of great operators and business people. Promoting from within is in its blood, best exemplified by how the current CEO of Momentum Industrial started working in their warehouse in 1995 and worked his way through the corporate ladder to now hold the top position. This also spills over to their acquisitional process, where understanding not only the financials but also a company’s culture and people is an important part of the due diligence process.

Ulf Lillius is another example of this. He’s had tenure in both Momentum Industrial in various stages (both as CEO, but also through other key management positions all the way back to 2002). He’s also served as a sales manager for SKF Multitec (SKF is the company that Momentum Industrial originally sprung out of) for 6 years and we’ve already discussed his journey from B&B into today’s Momentum Group.

Another interesting tidbit about culture in Momentum Group is their 80/20 rule: Management and boards are to spend 80% of their time discussing and working towards future improvement, and only 20% of their time on past experiences. This aligns companies with future improvements rather than focusing on things we cannot change.

Management - Spin to win

One of my key pillars to investment is investing alongside great managers that are competent, focused on shareholder value creation and have alignment through ownership or incentives. Throughout this piece, I’ve talked about Ulf Lillius and Niklas Enmark a bit scattered, but let’s dedicate some attention to these guys now.

Ulf Lillius’ history with the company has been discussed in this piece already, but his time with Momentum goes all the way back to 2002. He’s engineered the current structure of the Group, having led the decentralisation and spinning off first the original Momentum Group (Alligo+current Momentum Group, i.e. people and parts) and dicing up B&B Tools to reverse the failed experiment of centralisation in the 2010s.

CFO Niklas Enmark has a great background as well. He’s been with Momentum Group since 2017 and has been a driver behind the financial performance of the Group. Before joining Momentum, Enmark served as CFO of Lagercrantz from 2004 to 2011, and as CFO of Axel Johnson International AB from 2012 to 2017. The latter company has deep ties to Nordstjernan, the leading owner of Momentum Group showing Enmarks connection to the key shareholder of the company.

Both have impressive track records of providing shareholder returns. During Ulf Lillius's tenure as CEO of B&B Tools, he steered the company through a period where they delivered a CAGR of 43% and as CEO of Momentum Group the company has provided shareholders with a 20% CAGR.

Whilst Axel Johnson International is a private company and therefore we can’t judge its share performance in Niklas Enmark’s time there, Lagercrantz performed very well during Enmarks period. During his tenure, shareholders enjoyed a 20% CAGR, and Lagercrantz has continued to perform after Enmarks period.

This is not to say that with Lillius and Enmark at the wheel, we’re guaranteed to see similar results but to highlight that this is a management team focused on shareholder returns. They have a track record to back this up.

Incentives and alignment

Ulf Lillius and Niklas Enmark hold shares in Momentum Group, but they do not hold controlling stakes in the company.

Lillius currently owns around ~1% of company shares, with a value of shares of around 70mln SEK. This is a substantial part of his holdings tied up to Momentum Group. Niklas Enmark currently owns just 0.1% of the company (65.5k shares) at a value of around 8.9mln SEK.

Per the remuneration report of 2023, Ulf Lillius had a salary of 8.9mln, where 5.16mln was fixed and 2.46mln was in performance fees and Niklas Enmark had a fixed salary of 2.9mln and variable at 1.13mln (values in SEK). Given that their share ownership in Momentum is close to 10x their annual salary it shows an alignment with shareholders. Add in that a substantial part is performance fees which further shows alignment with long-term value creation.

Momentum Groups performance criteria and management rewards

Performance criteria

Momentum Group's performance criteria for senio

r management are designed to align with the company’s strategy, profitability goals, and long-term interests. The main performance criteria for variable remuneration are:

Financial metrics - aligned with Group goals

EBITA achieving +15% per annum

EBITA/WC: Achieving >45% profitability

Non-financial metrics

Support for sustainability and corporate values.

Other strategic and long-term objectives as defined by the company.

Management Rewards

Momentum Group follows a performance-based remuneration structure, which includes:

Fixed salary – The base salary of executives, adjusted for market conditions.

Variable salary – Linked to financial performance (EBITA and EBITA/WC) and non-financial targets.

Pension contributions – Defined contribution pension scheme, accounting for 30% of the monthly salary.

Other benefits – Includes company car, travel allowances, extra health insurance, and occupational health care.

No share-based incentive programmes – Momentum Group does not have stock-based rewards for management.

Alignment

Honestly, I thought I might just skip this part of the research report. The reason for this is that I feel the way that both Lillius and Enmark have worked to engineer the current group structure tells us most of what we need to know about their alignment. But, as Momentum Group is highly focused on creating a good organisational structure for its sub-companies, alignment for key management can tell us about their consistency.

I appreciate that they do not operate with share-based incentives. However I would have liked to see a similar structure that is deployed by CSU: Bonuses linked to share purchases. But given the rationality of aligning management with the Group's goals of long-term compounding at self-sustaining levels and a rational growth target (15% p.a.) gives me confidence in the management’s position with the goals of the Group.

In the end, I believe we see a smartly designed structure for key management. They’re motivated by the “history” of their journey, but also aligned with shareholder value creation.

Acquisitions and growth

Momentum Group deploys a strategy of being an active owner, to acquire, develop and building a culture to grow and provide value to shareholders.

Momentum Group’s goal when buying a company is to build on its existing strengths, get an entry into new and healthy growing end-markets for their parts and after-market offerings, and find companies that have a good track record in which they can continue to improve and build on.

Momentum Group follows a structured and deliberate approach to acquisitions, ensuring that potential candidates align with its decentralized business model and offer opportunities for market leadership. The process typically spans months or even years, allowing both parties to establish trust and align expectations.

A common threat to serial acquirers is the fear of increased competition from PE funds and more and more acquisitive companies. I believe that Momentum Group has a key edge here. Yes, they are first and foremost an acquirer, but deeply rooted is the passion for their industries. They do not buy companies to lever them up and sell them later. Momentum Group aims to own companies forever and to keep on building the collective expertise of the Group and its product offering. I found an excellent quote from CEO Ulf Lillius in Reqs serial acquirer deep dive that I want to highlight:

"Underperforming companies are mostly worse than they look, and good companies are mostly better than they look. We don't have the management time to buy underperforming companies and are not superheroes to change them. We are not a PE turn around company. We are in the technical trade. We love people. We love customers. We like to build." - Ulf Lillius p. 33 in the report.

Key Aspects of the Acquisition Process

Identification: Companies are selected based on industry relevance and strategic fit within identified product verticals.

Evaluation: Due diligence is conducted by internal teams comprising operational, financial, and legal experts.

Integration: The acquired company must align with Momentum Group’s culture and contribute to short- and long-term profitability.

Read more about the acquisition process here.

Acquisition Criteria

Strong market position within a niche.

Proven financial performance (e.g., EBITA/WC).

Established customer and supplier relationships.

A focused business model that aligns with Momentum Group’s expertise.

Entrepreneurial leadership that fits the company culture.

Preference for majority ownership (at least 51%), with management encouraged to remain shareholders.

You can find more information about the acquisition criteria here.

Targeted Industries & Trends

Momentum Group seeks acquisitions benefiting from megatrends like:

Green transition

Digitalization

Demographic and structural shifts

They want to acquire companies with end customer segments with a strong Nordic connection, such as:

Steel and metal

Chemicals and pharmaceuticals

Automotive

Mining and ore

Energy

Paper and pulp

This is summed up by Momentum Group’s quote on the webpage:

As the new owner of a company, Momentum Group does not focus on revolution, but rather on evolution.

M&A at multiple levels

I’ve touched on this briefly, but Momentum Group does not rely on Ulf Lillius and Niklas Enmark to do all the lifting. They operate with several levels of acquisitional initiatives and activity.

The Group pursues acquisitions at multiple levels. Subsidiaries that meet the Group’s profitability target (minimum 45% EBITA/WC) can use acquisitions to expand, often through add-ons that strengthen their offerings or geographic reach. Business areas also conduct acquisitions, with dedicated teams focusing on specific markets. They have key personnel spearheading the acquisition throughout the various divisions, allowing for an overview but also a build-up of expertise to be established.

Momentum Group has a structured and experienced M&A team that primarily uses internal resources to evaluate and integrate new companies. The acquisition process involves not only management but also individuals from various operational areas who have firsthand experience in entrepreneurship and business divestment. Many team members have previously sold their own companies to Momentum Group, giving them valuable insight into the acquisition process.

Read more about their M&A teams here.

An acquisitional snap-shot - Askalon AB

In 2023 Momentum Group concluded the acquisition of Askalon AB. The company was added to the infrastructural part of the Group portfolio and is the largest acquisition performed by Momentum Group to date.

Askalon is a leading provider of advanced valve solutions for the power, refinery, and process industries in the Nordic region. The acquisition really strengthened Momentum Group’s position in a strategically important sector, snuggly fitting it in with the Groups ambitions in industries such as power and energy, as well as emerging green technology and water infrastructure solutions. The company comes with deep customer relationships and a long track record of good and sticky growth.

The quote from the CEO of Askalon, Mats Warnqvist tells us a lot about the rationale for selling to Momentum:

"When I took over the helm from my father in 1997, we had 20 employees and revenue of SEK 30 million. Today, we are established in several countries, with more than 100 employees, and have built up a leading position in industrial valves. It was important for me and my family to find a new owner that genuinely understands our business and our partnership with Emerson and that has the ability to develop the company further. We are convinced that Momentum Group is just the right company to further develop Askalon, both for the company and for our important customers and suppliers."

Through its partnership with Emerson, Askalon has a special position in the Swedish industrial markets. Emerson provides advanced valve (opening and closing stuff) and automation solutions to the power, refinery and process industries. Askalon has an exclusive relationship with Emerson which is an attractive partner growing well alongside some global megatrends such as automation and streamlining industrial processes. Emerson grew 14% year over year last quarter, and they’re a well-positioned company, making Askalon well-positioned to ride this tail of growth in the Swedish industrial markets (which are some of the most advanced and automated globally). It is also natural to think that this will lend well to the rest of the Group’s work with automation.

In true Momentum Group style, Askalon was able to acquire their first company just months after being integrated with the group, further underlining the Group’s M&A style of “if your porch is swept, then you do you”.

Askalon was a huge acquisition and has quickly become the cornerstone of Momentum Group Flow Technology division. When acquired in 2023 they added 369mln sek of revenue and 115 employees to a division that had 203mln in revenues and 46 employees excluding Askalon.

With a purchase consideration including goodwill and lease obligations, we see a 288mln sek purchase price allocation. It was acquired in June 2023, and I assume a flat earnings for H1 compared to H2. H2 results were a revenue of 212 million and EBITA of 13 million, so I assume 424mln in revenue and 26mln in EBITA. This gives us a first-year estimate of ~0.7x revenues and 11.1x EBITA ex. goodwill. I think it’s prudent to mention that Momentum Group recognises around 93mln for goodwill, basically showing that they were willing to pay up for a big deal. This indicates to me that they have ambitions and belief in the growth driver that Askalon can be for Momentum Group.

Given the size of this deal it looks like a shrewd business. The question remains if they are able to improve upon operations in Askalon, but it looks to be a new cash cow centred spearheading their expansion into Flow Technology for important industries.

Returns on acquisitions

Now it’s time to dig in a bit. I will start looking at numbers, and stop ranting about all these soft factors such as culture, decentralisation and so on. For serial acquirers, the name of the game is to ensure good profitability on their acquisitions. Before we start looking at numbers, I am convinced I have done mistakes. My strengths does not lie in math and calculation, so I want to be open about this limitation and encourage readers to be critical of my assumptions. Also feel free to point out the errors when you find them.

I’ve borrowed heavily from this piece by Kevin from

discussing ROICs and developing a more nuanced understanding of returns metrics. With two and three quarters of a year of investments from Momentum Group, we see the following results:The ROIIC profile is closing in on 30%. I think this might be a bit optimistic for the long run in regards to Momentum Group, and it is quite likely heavily skewed by the Askalon acquisition in 2023 which levered up the balance sheet of Momentum Group. We see first-year returns on investments (expressed through EBITA / Net sum paid) ticking up. Comparing my calculations with Momentum Group’s own reported ROCE averaging around 25% since the listing shows some alignment in the return profile I don’t think my assumptions are wildly off.

As we can see, I think Momentum Group is a great company in a position of moving towards being even better. Their return metrics are excellent and are improving year on year. The average is skewed by 2022 which was only formally started in March, and where management was heavily focused on landing the spin-off process as well as possible limits to travel by Covid-measurements.

Acquisition track record

Below you will find a more detailed overview of my acquisitional assumptions. I have plotted the average margin metrics for each business segment, where we see that Infrastructure posts lower margins compared to the Industrial segment. In addition, I’ve adjusted for the ownership percentage as Momentum does not always buy all the shares, but often has an option for full ownership in the future. I’ve added back in leases and calculated based on cash consideration + leases (i.e. excluded goodwill).

We can observe that the company typically pays around 5-7x EBITA and 1.5x revenues, creating some healthy returns on investments as listed above.

Considering the margins that the Groups companies post I believe a lower multiple hurdle is appropriate compared to say Lifco which typically pays 7x EBITA but buy higher-margin businesses on average.

All in all, I think Momentum Group has the track record and acquisitional strategy to keep on growing at sensible rates. There is going to be lumpyness in deployment of capital, and swings in M&A activity. The goal of the company is to acquire between 5 - 10 companies per year, which is a reasonable goal and bound to increase as growth progresses.

Valuation

I will approach my assessment of valuation in my typical two-pronged way:

What is the market expecting? Reverse DCF to see if Momentum is being priced unreasonably.

A multiple spread so that I (and the reader) can make our own judgements as to how the future might play out.

Reverse DCF

As we can observe, the market is currently pricing Momentum Group to post around 16.6% annual growth in operating earnings (cash flow) for the first 5 years, then down to 7% in years 6 - 10. I further add a 3% perpetual growth rate as an assumption based on the stability and run-way for growth that a serial acquirer operating in a less sensitive segment such as aftermarket parts to a widespread industrial customer base shows.

I would say that the growth of earnings expected by the market does not indicate that Momentum Group is a screaming buy right now. It looks to be a fair assumption.

The real kicker is that serial acquirers often have far longer runways for growth than the market accounts for. I assume that after year ten, we get the growth that is only slightly better than the current organic growth, and just slightly above the projected long-term inflation rate. I find that quite hard to believe. I find it just as hard to believe that Momentum Group will drop down to 7% growth after 2030.

I find it timely to point to the results of the Bergman & Beving siblings of Momentum Group, Addtech and Lagercrantz (amongst others). Lagercrantz has achieved a 17% EPS CAGR over ten years and 20.6% over five years, whilst Addtech posted 16.5% and 18.2% over the ten and five-year period. Momentum Group have a goal of compounding earnings above 15% annually per year (expressed as EBITA). They have so far exceeded their goals by quite a lot each year. What I’m trying to say is that: The medium-term expectations (that is the 5-year growth projection) seem to be rather fair, but in the long run, it seems that the market is underestimating Momentum Group by quite a lot.

If this research has added value to your investing, do consider paying back by treating me to a cup of coffee. I’ve had quite a few in my writing of this article.

Multiple Spread

I like to assess valuations through multiple spreads. These are ranges of outcomes, where I don’t want to point to a single possible outcome as the most likely to be the “right” one but rather present a multiverse of prices we can see in the future.

For serial acquirers, there are many ways we can approach valuations. I believe there are some key factors determining the value we should put on a serial acquirer:

The surety we can put on future growth and income

The speed at which they put cash into work through reinvestment rates

The rate of growth

How efficiently net profits turn into operational income, i.e. cash conversion.

Mostly based on rolling twelve months numbers, it looks something like this for Momentum Group:

You may see me use adjusted EBITA per share. This is not to dilute clarity and confuse, but I am inspired by

s piece on serial acquirers where he uses cash conversion to adjust EBITA for a proxy on operational cash flow.As we can observe from the above table, Momentum Group exhibits very healthy metrics. They do not quite achieve the level of cash conversion and reinvestment rates that VMS acquirers such as Constellation Software can boast of, but they have a very strong generation of operational earnings. Despite some fluctuations, we see that they also post very good reinvestment rates (I chose to include 2022, but would not put too much weight on it due to the special situation surrounding spin-off and COVID).

It swings quite wildly, and the average seems to be too optimistic. The reason behind the elevated reinvestment rate in 2023 is due to the acquisition of Askalon (talked about earlier in this piece) and the use of leverage that they opted to do to pick up all available deals (in which Askalon was a big one). I would put more weight on 2024 being a “normal” year for investments in Momentum Group as it was mostly bread and butter acquisitions (smaller bolt-ons) compared to the two earlier years. It does show that acquisitions are lumpy business, dictated by the availability of deals.

When it comes to the rate of growth, I’ll be basing my calculations on the company's target of 15% p.a. But looking at the three years of available information, Momentum Group has achieved the following EBITA growth:

As we can see, they grow very well at the time being. A lot of it is probably caused by the short time frame we have to work with, so let’s not get to carried away. But it’s reassuring to see that with the tough year of 2022 they still managed to overshoot their own goals of 15% EBITA growth by 4%. Organic growth has been pretty good, and I expect it to settle down at around 5% long term as stated by the company itself.

Potential multiple scenarios

As we can view by the table above detailing several key metrics, currently Momentum Group is priced to an EV/EBITA of 29,45. I want to be open about that the following table uses a P/EBITA and is a simple overview of potential share price development if Momentum Group is priced to different ranges of that multiple. It is definitely wisest to use the EV/EBITA multiple, but for simplicity, I provide the below sketch of a multiple spread in Momentum Group (EV can fluctuate and I don’t want to muddle into many future assumptions):

There is significant potential for a rating to hit returns. If we see Momentum Group lose some of the confidence the market currently has in its future earnings and rerate down to 15-20x EBITA, our investment returns (excluding dividends) will not turn out as well as we hope. I do however think we’re likely to remain in around the 25x EBITA range going forward, leaving an opportunity for returns that follow the underlying earnings growth. Time will show.

My above estimate is however based on the company achieving the bare minimum of its growth target. I find that to be a sensible approach to the future, and given the track record of Momentum Group recently (+20% EBITA growth annually) and the track record of the other industrial serial acquirers that have sprung out of Bergman & Beving, I would not be overly surprised by stronger-than-target growth. But I want to remind my readers that Momentum Group is no cheap company, currently trading at around 29x EV/EBITA which is at the very height of my multiple spread assumptions.

So a long story short, I see the sensible margin of safety baked into my assumptions and potential for positive surprises. Given the relatively young age of the current iteration of Momentum Group, its position in a fragmented market (a reminder that Momentum Group only have around 5% market share) and the track record of the B&B business model and management I see a good cause for optimism in Momentum Group.

Combine the assessment of expectation (rDCF) and potential (multiple spread) and it leaves me with the view that Momentum Group can provide me with attractive returns on my investments.

I have opened a position in Momentum Group at around 175 SEK average price.

Thank you for reading this, if you have made it this far I am impressed! I hope this has added some value to your process, and that you leave this article having learned something new!

Learning to Grow will be a free an sporadious publication. If you feel like paying back, there are several ways to do so. Most appreciate are if you send me a message or leave a comment, either to just let me know what you think or to point out an error in my assumptions. That will be most helpful!

I will also be very grateful if you share or subscribe. Seeing my reader count grow motivates me to keep going.

And I have strewn links across this article to my buy me a coffee page. It is of course voluntary to do so, but I do love coffee and any contribution to my Arabica-addiction is highly appreciated. Again, thank you so much and let’s keep on compounding!

Sources (of inspiration, straight up cloning, numbers and more):

Req Capital - Lessons from Acquisition-Driven Compounders

Req Capital - Investor Letter FY2024

The power of distribution, value add and customer service - Founders episode #360 on Fastenal founder Bob Kierlin

Diploma PLC Business breakdown - A great piece to learn more about the power of distribution, parts and acquisitions

Torghatten Capital FY2024 review (pages on decentralisation).

Outsider Corner - Serial Acquirers, The Generalists

Atmos Invest - To boldly go, beyond ROIC

Reports referred to that can be found outside the Momentum Groups IR page:

As always: None of this should be understood as investment advice. I am a hobby investor, with no professional training. I may sell or buy stocks without disclosing it at once, so you should not be following me. Do your own research, or you are bound to lose conviction when convicition matters.

I look at it in terms of peers: Lifco is in negative territories, Lagercrantz and Addtech is close to same level in regards to organic growth. Industrials are struggling right now, but it's an important piece to pay attention to.

Looks like organic growth came down to just 1% in Q4 and 3% for FY24. Any concerns on your end about the slowdown here? Their leverage still appears fairly manageable, but they will need to do a lot of acquisitions to maintain 15% growth if organic does not pick up.