Norbit - A profitable problem solver

A hidden small cap gem with stellar management and good growth that presents a potential nice return on investment.

One of my highest conviction holdings at the moment is Norbit ASA. The company is a Norwegian niche technology producer and developer that has rewarded shareholders with a 29% CAGR since it went public in 2019.

I believe Norbit has the opportunity to continue compounding thanks to it’s position within economic tailwinds such as connectivity, blue economy and security.

Before we go on, here’s Norbit at a brief glance:

EPS: 3.1 NOK (CAGR ‘17-’23: 35.6%)

ROCE FY’23: 29% (average since ipo: 12,6%)

Gross margin FY’23: 59.5% (average ‘17-’23: 52.6%)

EBITDA margin FY’23: 25.8% (average ‘17-’23: 15%)NIBD/EBITDA: 0,52 (FY23)

At a glance the company has shown a good growth in earnings, they’re capable at employing capital at good rates of return, capture value through good margins and are very healthy financially.

A great base to build upon, and in this article I’ll expand and provide detail on the business.

Article overview:

What is it Norbit does?

Business segments

Strategy, ambitions and trends

Management and ownership

Overview of Q1 results

Valuation

Let’s dive in!

What is it Norbit does?

Norbit ASA was founded in 1995, in the middle of Norway. It started as a developer of tailored technology solutions. In 2009 the current company structure was established, with the company split into three main segments of Connectivity, Oceans and Product Innovation & Research. Throughout its history it has driven business expansion through acquisitions and development of its own technological products.

This list of events from before the IPO of Norbit gives an overview of the Norbits beginnings and major additions to the company:

Since its early innings as a small company based out of Trondheim in Norway, Norbit has built a global presence. Norbit’s expanded through research and development in cooperation with partners and acquisitions which have strengthened their product offering and vertical integration of distribution and components. Currently its biggest revenue segment is its sonar offerings, whilst the original business segment of PIR is the smallest contributor to Norbit's earnings.

This highlights how the company have been able to capitalize on its winning products and have underwent a transition from producing for others, to establishing an independent product base. Below is a picture of the company’s current global presence:

Another success factor for Norbit has been its connection to Trondheim. The city is one of Norway's largest technological hubs. Thanks to its connection to NTNU, the biggest technological and engineering research hub in Norway, Norbit has access to engineering research and talent. The management is very outspoken about their focus on developing talent and enabling their employees to grow and create new products and technologies.

Norway is no U.S. when it comes to innovation, but the country has a long standing culture and tradition for being excellent at ocean engineering and technology and Norbit is a prime example of this.

Norbit have identified six main secular trends that they are positioned to grow alongside with:

Segment overview and product highlights

Norbit is divided into three main segments (FY 2023 revenue split):

Oceans

Connectivity

Product Innovation & Realization (PIR)

Revenue split between segments are as follows:

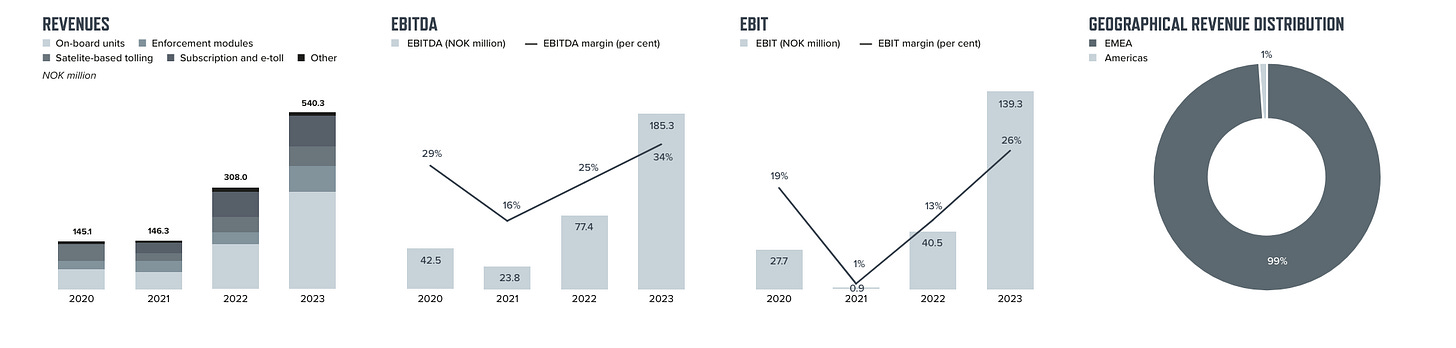

Oceans (38.65%): 599mln NOK for 2023 (EBITDA margin: 35%)

Connectivity (34.84%): 540mln NOK for 2023 (EBITDA margin: 34%)

PIR (26.52%): 411mln NOK for 2023 (EBITDA margin: 13%)

Now I’ll give a rundown of the various segments products, and show the segment internal splits of revenues. The numbers are from the annual report of 2023. I have chosen not to include Q1 as I’ll deal with that separately.

Oceans

Oceans is Norbits biggest segment when it comes to revenue, and it’s highest margin segment. Users of the products from the ocean segments are a broad range of companies, but they stem from: Offshore energy companies wanting to monitor their platforms and installations (such as oil, gas and offshore wind), harbours monitoring vessel movements, environmental mapping done by engineering or environmental firms, fishing and aquaculture monitoring or regulating et.c.

The segments product offering consists of:

Subsea: consists of sonars that are mountable on small vessels, automated sonars for detection and mapping and AUVs that allows its users to navigate freely and map sub-surface environments to great detail. Norbit's main specialisations are ultracompact and wideband mulit-beam technology.

Security products are smaller subsurface products that enable monitoring and surveillance of installations at sea and in harbors.

Aqua products are light and sensor technology for fish farms and other bio-producing ocean businesses.

Aptomar is Norbit's offering of installation based environmental monitoring and surveillance, that enables customers to monitor, detect and report instances of vehicle collision avoidance, oil spills or environmental monitoring of birds or other species etc.

Connect delivers customized cable assemblies, electromechanical box builds and operational solutions.

Below I show the revenue split of the oceans segment. Sonars are their headline product in this segment, and especially their Winghead sonars (viewed as the worlds best sonar for their segment)

Connectivity

The second largest segment of Norbits revenue is Connectivity. This segment mainly consists of on board-units (OBU) that report tolling data automatically. OBU sales have had a strong growth the last years thanks to new EU regulations requiring transport and trucking companies to monitor data connected to driving time and border crossing (amongst other).

Norbit have capitalized on this regulation greatly, and are a leading provider with customers in many international blue chip companies. Earlier this year secured a large contract with an unnamed customer for OBUs totaling 160mln NOK. The product portfolio for connectivity is split in two:

Intelligent traffic systems (ITS) is Norbits offering of OBUs and tachographs that are dedicated short-range communication technology. It automatically reports necessary and regulated data on border crossings, driving range and speed and tolling information.

Smart data consists of software and services related to fleet management and vehicle monitoring that takes advantage of the data provided from Norbit's ITS services.

Both the ITS and smart data segment have established relations with blue chip transportation companies in the EU, insurance companies related to vehicles and tolling, and driver data and more. It’s a recent addition to their portfolio, and shows Norbits ability to identify a problem and provide technological solutions where there’s a robust demand.

Partnering with toll processing companies has been an important strategic expansion for Norbit, where they work B2B with AutoPassing tolling segments in the private sector where they can innovate together with their customers. This partnership approach has increased profitability and given Norbit better future visibility according to the CEO in their investor presentation for Nordnet in 2022.

PIR

The PIR segment was Norbit's original business, but is today the smallest portion of the company's revenues. It is also the segment with the lowest margins. However, PIR is a way for Norbit to capitalize on excess manufacturing capabilities, and is in my opinion a smart way of squeezing the juice out of Norbit's capabilities.

Having localities in Europe and Norway is also a good way of benefitting from the current reshoring trend, and the company maintains that it should be able to raise margins and demand going forward. This segment will always have lower margins than their proprietary segments due to Norbit manufacturing products for others, and as manufacturing is simply one part of the value chain less of the value goes to Norbit.

PIR is split into two sub segments:

R&D is Norbit's way to use their technological and engineering capabilities to create products on demand from customers. They basically enable their customers to realize their ideas, and create long lasting relationships. Norbit works with customers in mainly hardware, but sometimes software development. This is a segment that in my opinion creates value for the company outside of simply generating revenue. It enables Norbit to deepen their relation with customers through directly solving challenges that the customers experience. This approach lets Norbit identify and solve key issues for their customers, and is in my opinion a great competitive advantage for the company.

Contract Manufactoring is how Norbit uses their factories and manufacturing capabilities for customers. This is a way to utilize excess capabilities to squeeze more revenues out of Norbit's assets. After a strong run in product manufacturing many companies such as Note, Kitron and InCap have seen headwinds, and so have Norbit. I’ll expand more on this in the commentary of Q1 later in the article.

Has this introduction been helpful for your investment process? This substack will remain free for the foreseeable future, but I would be very happy if you pitched in for a cup of coffee.

Competition

As Norbit is a niche provider and developer, most of their products are aimed at addressing targeted needs of their customers. In their product mix they have both horizontal and vertical niches.

In the sonar landscape, competitors are companies such as Kongsberg, Raytheon, Teledyne and R2 Sonic. There’s a wide array of other providers of fleet management and OBUs, such as Movyon, TollNet and Trimbletl and in manufacturing there’s a wide landscape but to mention a couple of nordic peers one can have a look at Kitron, Note and InCap. The manufacturing companies however have a broader portfolio, and are often closely tied to various customers with long standing relationships.

As Norbit is a niche provider, their products stand out in the mix and are built to address concrete needs, often developed through partnerships with their customers. This creates stickiness. On the manufacturing and R&D side this is a service for Norbit to deepen relationships with customers, and as mentioned squeeze out the capacity they have at all times. There’s no doubt that Norbit operates in competitive segments, but they have so far managed to navigate these waters well.

Synergy and coherent business model

Norbit's segments do not share obvious synergies other than their manufacturing capabilities. However the company is positioned to grow in sectors related to sensors, niche technological markets and addressing customers needs. Most of their markets are also highly fragmented, presenting opportunities for establishing their products as leading niche products.

When it comes to their manufacturing capabilities in the PIR segment, the CEO Weisethaunet explains some qualitative strengths related to their contract manufacturing (translation done by me, slight paraphrasing):

Aside from the fact that we can use our remaining capacity, we have many customers who have strict demands and expect nothing but the best from us. This strengthens and sharpens our organization. It also adds value through our production line being exposed to competition and this efficiency makes us not only better at producing our customers products, but our own products as well.

Risks and a brief comment on the Covid-19 impact on Norbit

Risks to Norbit are several. Any technological product developer is exposed to risks related to technological disruption and obsolescence, and Norbit faces this risk as any other company in this segment. As mentioned in the rundown of potential competitors, we also see that they operate in a crowded space with large actors around them. Right now the market is spread enough out to let Norbit do their thing, but as an investor it is important to keep your eyes peeled on competitors trying to step into Norbit's turf.

Norbit also face executional risks related to their acquisitions. Through their M&A, they might miss and overpay or buy companies that do not fit into the culture or product offering of the company. This is something any have failed at before them. For now, Norbit seems to be navigating these waters well. I’ll give some more details on acquisitions later on.

Another risk for long term investors is the potential for a takeover. Currently the management seems to be in it for the long haul, but with their unique proprietary technology bigger actors could look to buy out shareholders of Norbit to snatch up a great product portfolio and talented team.

During the Covid-19 crisis, Norbit experienced severe challenges related to components and manufacturing. They had a tough time finishing orders, delivering their products and getting parts for their production lines. This hit Norbits free cash flow and margins hard. The CEO is pretty straightforward when he says that they were not prepared for this. However, the experience from the pandemic might just have turned into a tailwind for Norbit as the homeshoring trend seems to be gaining strength.

Strategy and ambitions

As a niche and mission critical technology company, Norbit’s main goal is to strengthen its current position and expand into new profitable technological niches that fit their business model.

This quote from the CEO at an investor presentation for Nordnet gives a nice insight into the company’s strategy:

We work with tailored technology in selected niche markets. For us an interesting niche market is where we see a problem that we have sufficient knowledge on a vertical so that we can develop the technology that can solve said problem. We prefer it when the problem is hard to solve, because if a product is easy to make, it’s hard for us to operate alone over time in this niche and we get competitors.

Another important factor for us is scalability, if the scalability is astronomical we leave that opportunity for Google, Huawei or another giant, and we look for something that is the right fit for our size and position.

This quote shows the sober focus Norbit have on their business edge. They strive to tailor new technology to their customers needs, and prioritize strong relations with their customers.

This enables them to meet the needs and demands of potential future customers, and strengthen their product offerings in sticky ways. There’s the added strength that they develop new products with partners, building long lasting customer relationships. This R&D approach is in my opinion an important strength for Norbit, as it helps the company align it’s developing of new products and services with customers needs, and as Weisethaunet himself has said “Over the years we have gotten really good at finding problems to solve”.

A compelling growth story continues

Since 2010 the company has increased revenues by 31% per year. Norbit have a track record of under promising and over delivering. In 2021 the company had revenues of 790mln NOK, and the management guided for reaching sales of NOK 1.5bln by 2024. This ambition was achieved a full year ahead of schedule, as they achieved revenues of ~1.52bln NOK in 2023.

The new ambition for Norbit is to reach an organic revenue of 2.7bln NOK, and by adding M&A they have ambitions for a total (inorganic) revenue of 3bln NOK in 2027.

They presented further goals for 2027, targeting (amongst other goals) a very healthy ROCE on 30%:

The CEO also highlighted that going forward the opportunity for growth is bigger than what it has been historically. In their communication, management seems to be invested in building an even stronger Norbit going forward.

Acquisitions

As acquisitions is a substantial part of the growth story going forward, let’s touch briefly on Norbit's track record for acquiring companies.

Since 2021 Norbit has invested ~250mln NOK and acquired seven companies. It seems that they have two main motivations for acquiring a company: Strengthen product integration through buying suppliers or distributors or broadening product portfolio through buying niche footholds into new segments.

An example of the first approach is the aforementioned acquisition of Seahorse Geomatics, a long-term partner in distribution in North American markets. An example of the latter is the acquisition of iData, a company that is the foundation of their smart data product segment that enhanced their offerings in Connections product segment.

They seem to be acquiring companies at sensible multiples, let’s have a look at three of the acquisitions they’ve provided multiples for:

iData: 11x EBITDA for a SaaS business model

Aurusund Maskinering: 5x EBITDA for a component supplier

Ping Digital Signal Processing Inc: 7x EBIT for an industry peer

Looking at their acquired assets reveals significant goodwill in only two out of seven transactions, indicating sensible acquisition practices.

These acquisitions gives Norbit an opportunity to deepen their relations through technological IPs and software, and should give the company a good runway for expanding their offering and growing into new niches.

Capital allocation policy

The company has a leverage goal of 1 - 2,5x net interest bearing debt to EBITDA, and a covenant of not exceeding 4x NIBD/EBITDA.

Norbit pays an annual dividend, with a goal of paying between 30%-50% of NOPAT to its shareholders. For 2024 the dividend landed on a total of 2.55 NOK per share, comprising of an ordinary dividend at 1.55 NOK and an extraordinary dividend of 1 NOK, resulting in a payout of 82% of NOPAT and exceeding their dividend payout ratio.

The reasoning for the extraordinary dividend is that the company have a very sound leverage of 0.52 NIBD/EBITDA for the FY23 (down from 1.41 FY22).

Excluding the extraordinary dividend, the DAGR of Norbit since its IPO in 2019 has been ~27%. However there have been some rough patches thanks to the component issues they struggled with during the Covid-19 period (annual dividend numbers from Børsdata.se):

The company is looking to achieve more growth through a bit higher NIBD ratio, which seems sensible for a growing company with opportunities on the horizon.

The acquisitions mentioned above have been driven by a mix of cash, shares and debt. As shown by Norbit's healthy balance sheet, they have been able to acquire companies mostly with cash and have not had to take on debt or issue (a lot of) shares.

Share outstanding (Børsdata.se):

Management and ownership alignment

Norbit was founded in 1995 by Steffen Kirknes. Kirknes is now retired, but is still a presence at Norbit and Kirknes along with his family remains the largest owner in Norbit (~16.3% ownership).

CEO Per Jørgen Weisethaunet is the largest single owner of Norbit (11.7%). He has been with the company from the beginning. Weisethaunet joined the company straight after finishing his degree at NTNU. The relation between Kirknes and Weisethaunet is a funny little tidbit, as Kirknes used to be Weisethaunet's Judo coach growing up, and that was how they knew each other and lead to Weisethaunet being where he is now.

Weisethaunet is aligned with the rest of the shareholders. His stake alone is worth around 450mln NOK at the time of writing (share price 65 NOK). In 2023 Weisethaunets salary was 8.1mln NOK, up from 4.4mln NOK in 2022, most of this in performance bonuses thanks to a record year for the company.

Performance based compensation

Executive compensation is tied to organic sales growth of 15-25%, EBITDA margins of 20-25%, and a total shareholder return of at least 25%, showing further alignment with shareholders in general.

Other notable owners

The third largest owner of Norbit is Reitan Kapital AS. This is the investment company of the Reitan group, which is the family of one of Norway's largest grocery chain, Rema 1000. They are a family based in Trondheim, and are large investors in the region who have a track record for being solid owners looking for long time partnerships. Reitan Kapital owns 9.7% of the shares and are represented in the board of Norbit.

Other notable investors are AWC as (~2% ownership), which is an investment company for the A Wilhelmsen family (successful Norwegian shipping dynasty), also characterized by long term ownership, and the brothers Eide, who are local investors in the Trøndelag region with around 7.6% ownership. Around 47.3% of shares in Norbit are tied up with a mix of long time owners providing stability for the company.

Tax related sales of shares?

In the spring of 2024 founder Kirknes reduced his stake in Norbit from around 19% to the current ~16% ownership. Kirknes has not commented on the reasons behind the sale of shares, but I find it reasonable to explain the sale of shares in two factors unrelated to the company’s future:

Kirknes is 71 years old, and retired. It is his time to reap the benefits of the work that he has laid down in Norbit.

The Norwegian wealth tax is based on (amongst others) share ownership. With the last couple of years share price appreciation Kirknes’ fortune has grown significantly, and Kirknes last year commented publicly on the toll on his income by this tax.

All in all I’m not too stressed about this sale. I would be more concerned about a substantial sale from Weisethaunet. Kirknes also sold the shares outside of regular markets. Despite this causing a temporary share price drop, I find this to be a shareholder friendly way of solving it, as selling this many shares in the open market would put a negative pressure on the share price over a long period thanks to Norbit's low volume trading.

The managements track record for achieving their goals:

As mentioned earlier, the ambitions for 2027 are high, but I deem Norbit as a company that sets realistic goals with a management team that have a proven record of achieving these goals.

First quarter in a new strategic period

Norbit presented its first quarter earnings 15. May. During the presentation the CFO of Norbit, Per Kristian Reppe, said that the quarter was not up to their standards.

Let’s go through each segments results for the quarter briefly, then a summary of the outlook and interesting questions from the conference call.

Oceans:

A weak quarter for the strongest segment of Norbit. They experienced lower sales on winghead-sonars compared to 2023. The segment ocean had a revenue decline of 11% yoy. Gross margin landed at 28%, which was a decrease of 3% from last quarter.

They generally described this as a weak Oceans-quarter, and explained some by cost pressure related to high costs growth in salaries, and costs related to last year's acquisitions. There’s also a lower visibility in orders on sonars, as they usually are made 3 weeks before delivery, allowing for quarter-to-quarter order volatility.

Connectivity:

Connectivity had a great quarter. Revenues grew by 10% compared to last year, maintained strong margins of 28%. The company highlighted that much of the growth was driven by strong demand for tachographs and satellite based tolling. I’m also happy to see good growth in their subscription based services, growing by 28.5% YoY. Growing their software offering will contribute to increased margins.

PIR:

PIR had good revenue growth, but delivered weak margins. This was mostly driven by finalizing a large low margin project during the quarter. This was highlighted during the Q4 call, and nothing unexpected. It is good to see revenue growth, and management underlines their ambition to shift towards a higher margin product mix. For the quarter reporting revenue was up 29%, but adjusted for inventory it was only up by 16%.

Balance sheet

Norbit reduced their Net interest bearing debt by around 14mln NOK, and NIBD/EBITDA remains at 0.5. They maintain a strong financial position. Cash position is flat YoY and looks good. Their NIBD/EBITDA ratio could point to possible acquistions or bigger investment into production lines or new technology.

Outlook and expanding comments

The company reiterated their short term guidance for the current year, as well as their long-term ambitions. The CEO and CFO mentioned that they currently see very strong demand in their sonar offering, and expect strong growth in the segment going forward.

On the more pessimistic side of news, they see weaker demand for OBUs going forward and several clients have rescheduled their orders to an undisclosed date. The CEO could not comment on when to expect these orders other than that they have taken this into account when reiterating their guidance.

They expect PIR product mix to move to a better margin environment going forward, and are meeting margin challenges by focusing on working with partners and customers to find the best third party products that fits both Norbit and their customer.

The big news was that they gave some color to the recently announced 160mln NOK contract with an European blue chip customer. Weisethaunet said that the order will be delivered in 2025, and that this is a new product and a new customers first order. Big order, and big customer, for a new product. This is good news, as Norbits road to success is to continue to create and find new niches to solve their clients problems.

The strategy to expand and broaden their product portfolio shows their strength this quarter. When what has historically been their core offering, sonars, have a weak quarter, their new star offerings in connectivity picks up the slack.

For an analyst take on Q1, I’ve attached the quarterly review by Pareto Securities in the bottom of the article.

Valuation

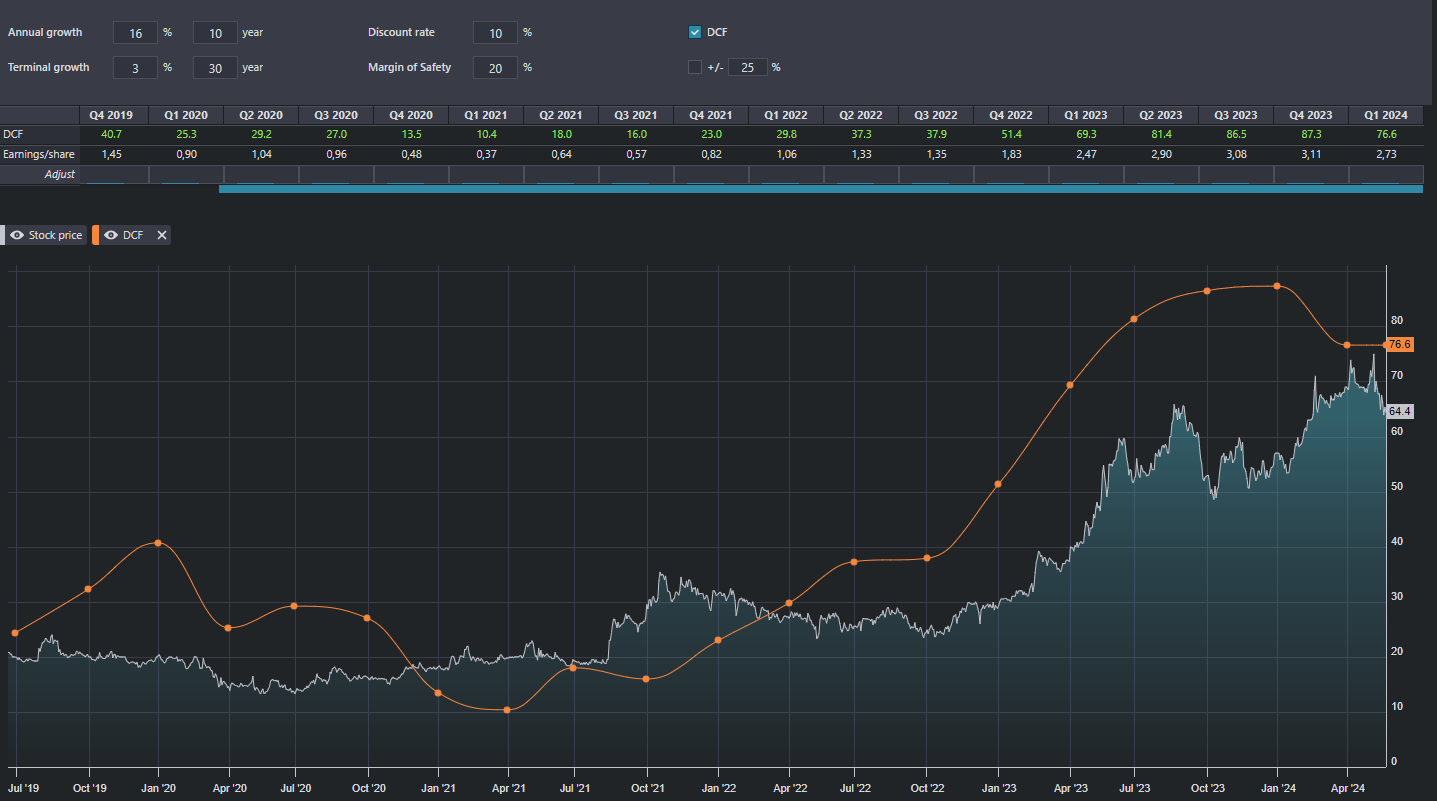

I’ll approach this valuation in two angles. First I will run the company down through two reverse DCF “models”, to see at what growth the market values Norbit. Secondly I want to see the company from various price to earnings scenarios, and provide some insight into a forward looking DCF.

Currently the shares are trading at around 65 NOK. Let’s remind ourselves of some estimates and key metrics per share of Norbit:

The blue field on the right is estimates from analytics covering the company. Norbit is a small company, and has an equally meager covering by analysts, so let’s not read too much into that. What’s interesting is the current OFCF, EPS a PEG.

It is notable how OFCF is higher than earnings per share, which is a result of disproportionate amortization changes for the year.

The (O)FCF yield currently stands at an attractive 8.9% for Norbit, with a PEG of 0.31. EPS growth is expected to grow steadily into 2027 by analytics, and they expect a ~20% EPS growth yearly for the next three years.

Reverse DCF examples

Given the current share price of around 65 NOK, I’ve used Børsdata’s DCF calculator to find a reverse DCF estimate. The base assumptions for the calculation is a MoS of 20%, discount rate of 10% and a terminal growth of 3%. Results show that the market is pricing a 13,8% annual growth for Norbit.

I also ran the company’s annual report numbers through a reverse DCF template:

Here we can observe that the market gives a rather conservative growth estimate for Norbit going forward at a 2% growth rate the first 5 years. The difference between this template and Børsdata is that there’s no margin of safety baked into the spreadsheet above which makes the growth targets less affected by an arbitrary number (20% MOS).

I find the company to be valued attractively. Let’s try to peek into the future by doing a P/E multiple scenario spreadsheet and a forward looking DCF.

P/E spread

Norbit has a shorter track record, going public in 2019 gives us just 5 years of history to base the following assumptions on. This is a short track record for it’s pricing, so let’s not put too much weight on the average.

Norbit has had an average P/E since 2019 of 28.4. It is important to note that thanks to supply challenges during the Covid-19 crisis Norbits earnings were negatively affected and this elevated the P/E ratios during 20/21.

With the power of hindsight, this was shown to be a short term problem, and they have now caught up to demand. The last three years Norbit have had an average P/E of 21.6.

Norbit have had an EPS CAGR of 13.5% since it’s IPO, and for the publicly available time period of 7 years (Norbit provided EPS -numbers from 2017 related to the IPO) Norbit have seen an EPS CAGR of 27.4%. The last 3 years growth looks extra appealing, with a CAGR of 49% growth.

This is however not something we should care too much about as the comparisons from 2020/2021 were very weak due to the aforementioned Covid-19 component issues.

I’ve calculated potential returns from a basis of several price to earnings multiples and EPS growth. For a bear case I have imagined a scenario where Norbit fails to expand it’s product offerings, and they achieve less than half of what they achieved in growth for the 5 year period since IPO.

I’ve got two medium growth scenarios. One where the company manages to grow it’s EPS by 10%, and one more optimistic with 16% EPS growth aligned with managements revenue growth ambitions.

Lastly I’ve taken the 7 year period of CAGR of 27% for an optimistic view. As this was an early phase of growth, I view this to be too optimistic, and would not set this as the expected returns.

I wouldn’t be to surprised if the company got a P/E rerating if it manages to continue growing at the current pace, achieve managements ambitions, and expand into new niches.

I have a personal hopeful expectation of a rerating to a P/E of 22, and an EPS growth of around 16% going forward, leading to a potential 17% CAGR on shareprice on an investment made at 65 NOK. I deem this as achievable, attractive, but a bit hopeful.

Again, let’s turn to Børsdatas DCF calculator to make some assumptions about the future. In the following calculations I’ve accounted for 3% terminal growth, 10% discount rate and 20% margin of safety.

In the first scenario I put in a worsened growth rate down to 10% annual:

In the second scenario I expect a growth aligned with management guiding for revenue growth at 16%:

In the third I’ve gone for an optimistic but reduced growth rate at 20%:

One of my issues with a DCF is that you have to make assumptions about the future. I have no crystal ball, and have no way of telling the future. Therefore I find it interesting to see several growth scenarios compared to each other, both in terms of P/E and forward DCF but we should all remember to stay grounded when dealing with these forward looking assumptions.

I prefer not to set price targets when evaluating companies. I find it reasonable to expect a around 10-18% annual return on an investment made at 65 NOK. I initiated my position between 49-53 NOK this fall, and I’m looking to add more. However I remain vary of the total allocation to what is a young and growing company. Norbit currently sits at a 7.5% weighting of my portfolio.

Thanks for reading all of this so far! If you found this analysis helpful and insightful, please consider giving me a motivational boost by buying me a cup of coffee.

Summary and more to read!

Before we wrap up, let’s match Norbit against my investment pillars:

Ability to reinvest well into business growth: ROCE 29% for FY2023 with ambitions to achieve 30% ROCE going into 2027 ✅

Competitive advantages: Gross margins of 60% and EBIT Margin of 20% ✅ (Hard to evaluate compared to peers due to the sector spread of peers.)

Fundamental growth: EPS CAGR of 27% last 7 years, and grown NOPAT at 18,7% a year since IPO. ✅

Skilled management aligned with investors: Management is aligned through achievement based compensation, large stake in the company and long track record.✅

Low or no debt: The company is well capitalized with an NIBD/EBITDA of 0.52, with a goal to increase leverage and boost growth going forward. ✅

Norbit is an exciting company in the Norwegian market. There’s not a lot of these quality niche growers in Norway, especially not in the technological market space.

They have shown an ability to compound over time, have a constructive but restrained focus on creating value for their customers and shareholders, carving out their place in various niches through solving tough problems.

The valuation is still attractive with a forward P/E of around 16 despite the share price run up these last three years. Management have a long history with the company, and have proven their ability to grow.

I see Norbit as a potential compounder going forward. There’s unfortunately not to many of these in Norway, but I hope to see Norbit continue to deserve the label for many years going forward!

Further reading and sources

Contrarian Cashflow has written an excellent piece on Norbit on his webpage. Read it here.

Disruptive analytics covered the company last summer. Read it here:

Norbit first quarter 2024 presentation and report.

The board of directors’ remuneration and salary report of 2023.

Pareto Securities Q4 and Q1 report, providing analytic commentary with a run down of their estimates and view on the company:

A brief product introduction of Norbits blockbuster product, the Winghead sonar:

In Norwegian, but it is a good introduction to management and the company:

Podcast-interview with CEO (also in Norwegian) by the podcast of Arctic Securities.

For people who understand Swedish, the podcast Aktiesnack have several discussion about Norbit:

I frequent the StockUp discord where I first discussed this company last summer. Join the server to join a great casual community discussing quality companies: https://discord.gg/E7eP6pCe

Nothing I’ve written in this article should be understood or interpreted as investment advice. I’m a simple hobby investor who likes writing, and I am not competent or qualified to be giving investment advice. Do your own research, be critical of my assumptions and look into the companies discussed before making any investing decisions.

At the time of writing I hold shares in Norbit.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e

It's been a year since you posted this. Things have changed since then, including the share price.

For me, there are four key drivers of driving durable shareholder returns:

1. Sales Growth

2. Margin Improvements

3. Multiple Expansion

4. Reduction in Share Count

Norbit has been driving (1) hard and, judging by its ambitions, will drive this higher - so far so good.

In respect of (2), margin seems to have reached a plateau, so while this has factored into past returns, it is unlikely to drive future returns.

Most of the shareholder returns in the past year or so have been multiple expansion - perhaps irrational exuberance on the part of investors. The multiple now looks stretched. This would imply that no returns will be driven by this factor and, more of a concern, is that if the multiple contracts it will negate the positive effect of top line growth.

The share count has not reduced. If anything it has slightly increased. So this would result in mild dilution, also working against shareholder returns.

The way I see it - past performance will not be repeated in the years ahead. Best case scenario shareholder returns track top line growth. More likely, they will lag behind top line growth because of drag caused by factors (2), (3) and (4).

What is your view currently, given the doubling of the share price since you wrote this article (the economic value of the business certainly hasn't doubled in a year - so has the price run too far ahead of the underlying business?)

I welcome your views.