It’s been over a year since I started Learning to Grow, and despite many posts, my first deep dive on Norbit has been my most popular piece. Writing about the company on other foras was what made me excited about writing, and gave me the confidence to jump into doing some proper research on companies.

Working on this follow-up piece has been a particularly fun thing to do. Just by writing and research Norbit anew I’ve noticed how much I’ve learnt since starting this project.

Another bonus is that Norbit has since the release of the deep dive on May 29. 2024 delivered a total return exceeding 200%. It is sheer blind luck that my first deep dive could post these sort of results, and it is not something I would’ve counted on a year ago.

I don’t want to write a victory lap of an article. The focus will instead be on the things I at the time did not properly cover, and the developments since. I also want to ask myself the question: What do I expect going forward, and how do I think about Norbit’s current pricing. I will try to direct the spotlight towards the errors of my judgement in the first article and try to highlight the learnings from dissecting the development versus my expectations.

In short I’ll cover the topics:

Acqusitional track record

A deeper look into growth investments

The defense story

Pricing, and the current opportunity

Before we go on, I’d say my article from one year ago is still very relevant in terms of learning the basics of Norbit. The core of the company remains: They are solvers of difficult niche problems by applying engineering expertise, a go-get-them culture and a relentless focus on profitability throughout their business.

Recommended pre-readings:

My original deep dive into Norbit from May 2024:

Deep dive, products and history for Norbit Oceans - Erik Stangeland.

Deep dive, products and history of Norbit Connectivity - Erik Stangeland:

Acquisitional track record

Norbit has over time proven itself to be a shrewd acquirer. They have strategically bolted on new markets and product dynamics through acquisitions of companies operating in their sphere of innovation and products.

This element of Norbits business was not something I spent a lot of time on when I wrote my first piece. Over time my focus has shifted to companies that have a proven track record as acquisitional leaning compounders, so applying this new-found lens has been very valuable.

Norbit typically does three forms of acquisitions (examples inside):

Vertical integration of distribution, production or product development (Kvikna Ehf, Kabelpartner, Aursund Maskinering)

Production expansions at opportune times (The Røros Kitron Microelectronics, Asti Selbu Factory)

Product portfolio expansion and strategic tuck-ins (Aptomar, SeaDarQ, Ping DSP)

As we can observe, Norbit has a good discipline in terms of how much they pay when they acquire companies. They typically pay in the range of 0.5 - 2x revenues for their smaller deals. Innomar is the one that sticks out, with a multiple paid at EV/EBIT of 6.1x 2023 results (to be expected given Innomars size and strategic fit).

Another soft factor in terms of their acquisitions is that Norbit has a tendency to improve their product acquisitions via better sales and product development. In Q1 2025 CEO Weisethaunet commented on the fact that Ping DSP have accelerated in growth after joining Norbit, pointing to this factor.

The same can be said for Aptomar, which went from being a standalone company aimed at selling measurement devices for oil and gas installations to becoming a more broadly spanning sea-based installation monitoring company.

Aptomar was bought when in the rough aftermaths of the oil price crash in 2014 - 2016 which hit Norwegian oil and gas production hard. After joining Norbit the company got it shit together, expanded it’s offering, probably got adapted to new applications for a diversified use-case and has now become an interesting part of Norbits product portfolio. Later, Aptomar even did their own acquisition when it bought the SeaDarQ Radar System monitoring product. This type of decentralisation is something that is very common among the elite of acquirers.

Norbit is connected to one of Norway’s most prominent geographies for technological and engineering competency areas in Trondheim where the foremost university for engineering and innovation resides. We see that they pick up some patents and products which I suspect they have found via their network in Trondheim, such as AblePay (bought from, amongst others, NTNU Innovation and Sintef), Nicarnica Aviation (an arial partical monitoring system which was held in a limbo after an ownership dispute between the innovator and risk capital, also originating from Trondheim). Both their factories are also located in the region of central Norway, where Trondheim is the centre of the region (broadly speaking).

Below you’ll see an image compiling the soft factors and commentary that I have observed in the research of Norbits acquisitions.

Recent management commentary on acquisitions

After the first quarter 2025 result presentation, Per Jørgen Weisethaunet guested a Norwegian financial broadcast. The discussion touched on some interesting comments in terms of how they look to do acquisitions going forward.

Norbit does not want to buy turnarounds. Weisethaunet described it as such:

It’s a pretty simple rationale: We have a far too good return on our own investments in R&D to be putting capital to work on turning around companies that are worse.

Innomar serves as a blueprint for what we are looking for: Companies with positive synergies that we can extract. We want both the product and the people to fit.

We want to buy companies that operate within niches, because we want there to be a steep entry-barrier so that it’s not something generalists can compete with us in. That enables us to improve margins, if it’s hard to make and we are far ahead of the competition.

Further, he described the synergies they are looking to find:

Synergies we find is that under the Norbit global distribution umbrella and sales network, Innomar can draw a lot of positive synergies by transitioning from their order intake based sales growth, to our proactive sales department.

Another synergy we find is if there are companies with a technology that has a strong position in a niche market, but the technology itself is not as good as it can be. Then we can act as Gordon Ramsey in Kitchen Nightmares and fix their technology and production with our world class engineers.

Norbit is not looking to buy production companies. We want to either develop and improve proprietary technology, or find niche technology that we can distribute better and further.

Weisethaunet explained what criterias they base their acquisitions on:

We have two core criterias:

First: We want it to be accretive to our earnings.

Second: We want it to be a match with our culture where we are able to act as good and relevant owners for this company which we preferably want to allow to operate independently and that we can own forever.

On size: Preferably not larger than 10% of our revenue, but we have no clear profile.

We see this second criteria play out in how our engineers in Trondheim and Rostock act when they meet up. They recently met in a testing facility to develop some sonar products, and I could clearly see how much fun and excitement they have for tackling these challenges and developing new products.

Growth investments

As our favorite Trønder, Weisethaunet, said in the above outtake:

It’s a pretty simple rationale: We have a far too good return on our own investments in R&D to be putting capital to work on turning around companies that are worse.

Well, I certainly think that deserve some proper investigation into how the returns on their investments into R&D.

This part will not touch on the products which are made that results in the growing revenues and operational profits. For that, I cannot recommend reading the linked-above deep dives from Erik Stangeland on Connectivity and Oceans enough. He has done some very thorough work on the innovations and product development and penetration that is as good as you can get from a non-institutional investor.

In this section I want to highlight the internal capital developments within Norbit. Despite being a rather small player and company, Norbit has taken some significant steps since listing in 2019.

Before we dive into the numbers, I want to point to a quote (paraphrased) from the Q4’24 presentation by Weisethaunet on the latest satellite based tolling unit they were approached to develop by Toll4Europe:

For Norbit, we’re taking a big step in producing a new and tailored product with the satelite based tolling units. This is a step up to the big-boys league, and for those who have followed us for a while might remember me saying that we were not ready to do that when we had our IPO. Well, we have gotten there now and this will have many benefits for us. These tailored and branded products will naturally have higher margins, and make us a stronger company.

The above quote is an important part of the success of Norbit: They’re taking incremental steps up into better and better product lines and verticals. From making only the signal parts of a tolling unit, to a tailored, on-order specialised whole-product. It’s hard to overstate the difference in business strength: Norbit is now an integrated product partner to the largest European tolling solution company. Could we see a move into offering software solutions for the tolling companies, tailored to the customer? These are powerful ways to improve margins, capital returns and moats.

Well, let’s move on from gushing over Norbits improvement, and get to the numbers. We will now take a deeper look at:

Growth investments into research and development and property plants & equipment

Working capital management over a five year horizon

ROIIC on growth capital (excluding acquisitions)

Growth investments

In this section we will look at the historical investments into growth from Norbit. I want to touch on how investments into research and development as well as investment into hard assets (PPE) have evolved over time.

There is bound to be some maintenance expenditure in these numbers, particularly in the PPE investments. However, I believe that Norbit have shown a great ability to get pretty great returns from these investments and capital expenditure in large. But I want you to be aware that this is not a “true” growth capex picture.

Let’s start with the most “pure” of the metrics, the investments into R&D.

Investments in R&D Q1 2019 - Q1 2025

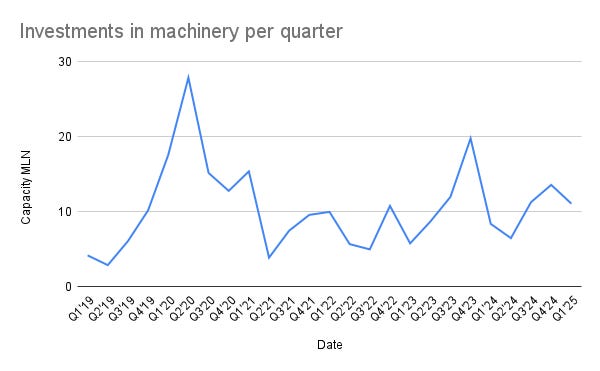

Within the category of research and development we find expenses related to developing new products. For Norbit this relates to products within Connectivity and Oceans. As we can see, it’s been a stable category of capital expenditure for Norbit since it’s IPO.

Since Q4 2023 it has accelerated, and lately it has thoroughly sped up. This is related to the development costs related to the Toll4Europe contract where Norbit is going to be making a new satellite based tolling unit (as mentioned before).

We should expect the spend for research and development to decline going forward, as they’ve been pushing to finish the product for Toll4Europe. Research and development expenses are expenses mostly aimed at creating new stuff, and I think we can safely assume that a lot of the expenses in this category count as expenditures which will lead to growth.

Take the tolling units developed for Toll4Europe: Weisethaunet has said that these aren’t contractually exclusive for Toll4Europe, and that they potentially could sell similar products to other customers. The caveat is that they probably would want to adapt it slightly so that they’re not breaking any normative loyalty towards Toll4Europe. Anyway, the large investments into developing these units should yield good returns going forward.

Investments in property, plants and equipment

Investment into these physical assets are most likely a mix of growth and maintenance expenditure. Norbit has two (well three) avenues for this spend: 1. Expanding excisting factories or 2. adding new production technology (and of course 3. replacing and upkeep). As I highlighted in the section acquisitions, Norbit has bought factories and sub-components producers (usually at a bargain price).

After the acquisition of the Røros and Selbu factories Norbit invested heavily into highly modernized and efficient robotic lines. The Selbu factory is being expanded to meet the demand for the Toll4Europe contract, and in Røros they’ve crammed in as many lines as they can.

Weisethaunet had this to say on the current production capacity:

It’s a tight fit currently, but the workers in Røros are getting good at sneaking into the tight room between the lines.

As we can observe from the graph above, they invested heavily into expanding their lines in Selbu and Røros from Q3 2019 - Q2 2020. This was an effort to ensure world class production lines, and we’ve seen the dividends paid for it this year as they have high capacity to take in orders from the strong European defense market.

In the last five years we see that the investments into PPE vary a lot per quarter, though there seems to be a concurrent 2-3mln spend as a minimum per quarter.

I think one important aspect to take into account here is that Norbit has had a long-term plan of creating high-quality production lines in Norway (and therefore also within the inner European markets).

This was something that a lot of people found to be an odd choice: It’s not many years ago since we thought trade would solve everything and that globalization was a never-ceasing march. Since the violent invasion of Ukraine from Russia, we’ve seen re-shoring become the freshest fashion. Thankfully, Norbit had the courage to work towards:

Full control over their own production lines. Having ngineers and production facilities being close to ensure top quality has been a guiding star for Norbit for many years.

An exposure to competition. As the factories get orders from outside customers, Norbit has the impetus to ensure that their production achieves high margins and produce efficiently.

Norbit achieves a dual effect on their investments into modernization and expansion of their production lines: They get to make their products better and faster, but they also get to extract more capital value from their external contracts. The location and expertise that operate within their factories also make them an extremely attractive partner for producers of electronic goods.

If we were to isolate out Norbit Product Innovation and Realization and look at it as an independent EMS company, they would deliver some of the absolute best margins and growth in their sector. Another soft factor that the company often highlights is that it’s a bonus for their engineers to be close to the production locations.

A couple of nuances that are important to note:

Costs related to developing internal products are never reported under PIR, but under their corresponding segments.

Their production capacity typically goes to 55-60% their own products, and 45-40% external contracts.

As we can see, for Q1’25 they delivered an normalized 23% growth and an EBIT-margin of 14%. Let’s compare that to some of the best competitors:

Kitron, one of the best EMS producers in the Nordics, achieved an EBIT growth of 18% and a margin half of Norbit at 7.6%

AQ Group saw a decrease of 3% and an EBT at 8.9%.

This is not to say that either Kitron or AQ are bad companies, it’s simply aimed at highlighting how good Norbits PIR segment is. That’s a result of the many investments they have made into modernizing, improving and expanding their production lines. It bears promise for the expansion of the Selbu factory this year.

Working capital management

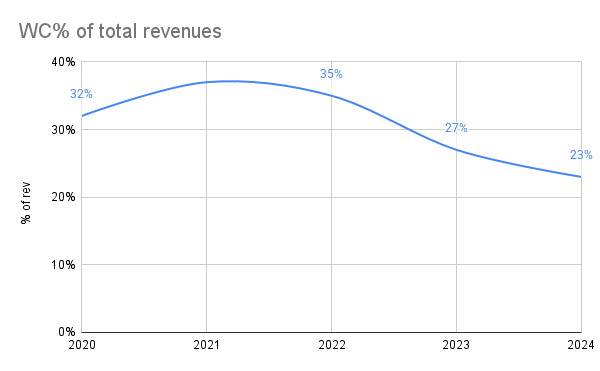

As an addendum I want to briefly visit Norbits working capital management. This is an often-times overlooked, but essential part of any industrially producing company. As Norbit produces, transports, stocks and sell their own products how they handle their inventory is key to their ability to generate cash efficiently.

It is good to see that their working capital as a percentage of revenues continues to improve. The only time we saw an uptick was in the Covid-19 shutdown, as the company stocked up to meet high delivery times.

What returns have Norbit achieved?

In the end, this is what we care about. I have previously highlighted the importance of understanding and identifying both lasting high returns on capital, as well as hopefully seeing rational ways of it either improving or inflecting.

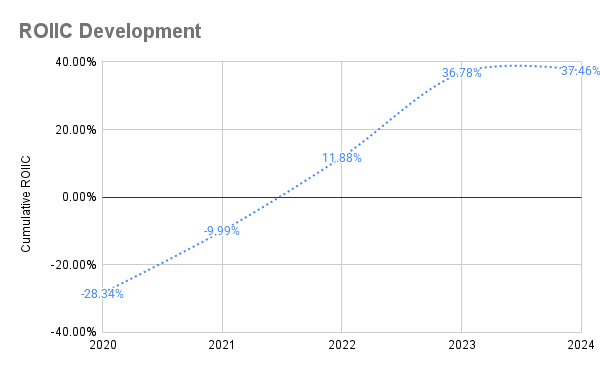

As we can observe from the above table, Norbit has been investing diligently throughout their years as a listed company. Investment rate shows EBIT (a lazy proxy for operational earnings) divided by their total investments (R&D+PPE). In the ROIIC calculations I’ve chosen to exclude acquisitions so far, as I was interested in finding their internal capital returns.

The cumulative ROIIC is the result of the corresponding year, less the baseline year (2019) divided on the total investments made up to that year. This is a way of showing how capital efficiency improves as investments accumulate and EBIT grows. Finally, the rolling ROIIC shows total incremental EBIT divided by the total investments made.

The ROIIC development is striking, and is in my opinion the key to understanding why Norbit has been such an excellent return-maker these last years. We have seen the holy cocktail of investment returns:

ROIIC is accelerating

Margins are improving (across the line)

Working capital is trending in the right direction

Investments are increasing

The key to understand here is that as Norbit grows in scale and complexity, they tackle more specialized jobs for higher paying customers. Transitioning from having many smaller customers buying their sonars for more scattered-nature jobs to making sonars for unmanned drone producers, or going from making one part of a tachograph to inventing a new tachograph that solves a tough job that the largest tolling unit company in Europe wants solved allows Norbit to gain scale, and therefore margins, as well as growth.

In the end, Weisethaunet made the most relevant point: Norbit is now playing in the big leagues, competing with the big boys.

Have this added value to your investment process? I highly appreciate it if you want to give back by buying me a cup of coffee:

The defense story

“The valuation of every company is simply a number from today multiplied by a story about tomorrow”, Morgan Housel, Same as ever (2023)

As Housel points out, there’s more to the valuation of a company than capital returns, margins and growth rates. The true heart of any valuation lies in the hopes and beliefs of the market.

Since the start of this year and the Trumpists rattling Europe and the continents established idea of American protection over the Old World the European defense sector has been ablaze.

As European countries shed fiscal skin for the sake of being able to be self-sufficient in our defence, the companies that either operate production of anything related to blowing others up (or defence as we like to call it), or develop and make defence-related products have rallied.

Kongsberg Gruppen, the foremost listed military tech company in Norway currently sits at multiples in the fifties. The largest Norwegian bank, DNB, has opened an “European defense fund”, and the defence sector is starting to give echos towards the green wave hitting the stock markets in the early innings of the Covid markets.

Norbit has not been spared of these lofty stories. They have been labelled as a two-sided defence story:

Their factories have seen a large uptick in orders from defence manufacturing customers.

Their sonars are found in many unmanned underwater drones, and we can probably identify drones from American, German, Turkish and many more defence producers equipped with both forward and side looking Norbit sonars.

Via the grapevine, I’ve heard that Norbit is an attractive candidate for these European Defence At All Costs investors: The historical growth and analysts assumptions puts Norbit in as a moderately priced exposure to the trend.

This is such a strong trend that in a recent interview Weisethaunet explained that they might start reporting in a new segment: Defence and security. Within the PIR segment, we even saw a wholly new slide pop up:

In addition to producing external products for other companies, Norbit supplies many things for the defence industries. Most prominently are antennas for military submarines, and sonars for UUV. With the leading edge sonar suite they have become an important partner for many of the best UUV producers across the world.

There’s quite low visibility in the customer base of Norbits UUV sonars, most likely as there’s a lot of high level clearance and secrecy clauses in their sales contract - but with some proper scuttlebutting many customers can show themselves.

I’ve previously highlighted the Oceans deep dive deck from Erik Stangeland, and I’ll remind you guys to check that out. He’s done a phenomenal job in identifying potential Norbit sonar customers. Another gem is the recently announced Copperhead torpedo drones from Anduril. There’s quite some likelihood that there’s a WBMS FLS from Norbit on the Copperhead 100, which would be a huge development. Again, the credit goes out to Mr. Investigator Erik Stangeland for making me aware of this development.

Having the likes of Anduril on your client list is no small feat. This is one of the absolute leaders in military technology applying Norbits tech. It’s an extremely promising position to be in. If these drones start being mass-produced, we could see some very large contracts ticking in for Ocean.

The true benefit of this development is that we should see margins expand as large customers come in with bigger and more tailored orders. In addition, Norbit goes to great lengths to make the products adapted to the end-user. Tailoring the product to the use of the end-customer thoroughly integrates Norbit into their customers value chain.

This story is probably a double-edged sword: It provides great momentum for now. But as many of these one-sided narratives we can’t forget to take into account that there is always a limit to growth. I would not be surprised to see Norbit end up being priced for perfection. But I do not think we are there yet.

We might be starting to see signs of more frothy assessments on the basis of the defense narrative, as Pareto released an updated analysis with a price target of 240NOK on 12.06.2025.

In their newest take they estimate a more than doubling of PIR revenues, a margin that lasts over the coming three years and a growth to 1.5bln NOK in PIR revenues by 2027. Pareto is well connected, and has traditionally been the most precise (and bullish) institutional house reporting on Norbit for as long as I’ve followed the company, but it’s hard to see that they account for any known contracts. Either they’ve caught wind of some rumour, or they’re extrapolating very strong growth.

In terms of the story-part, I doubt we’ve seen it play out all the way. There should be more to go on. But as always, when sectorial sentiment turns it pulls down the companies who’ve benefited from the trend. This is bound to happen to Norbit at one point. I would recommend any readers to be mindful of this.

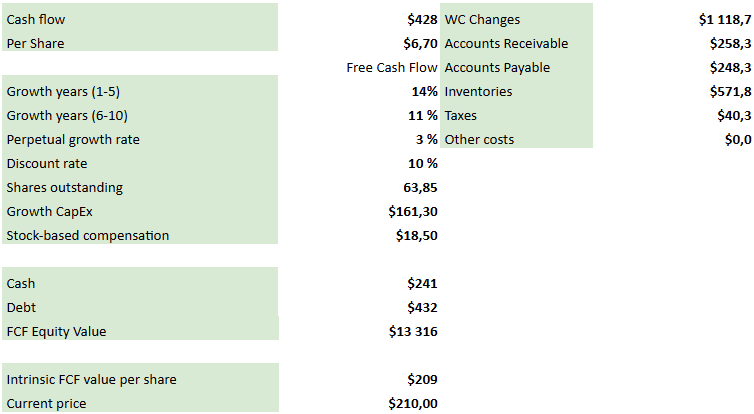

Pricing and forward growth

When I first posted about Norbit, it was priced (with the almighty power of hindsight on our side) ridicolously cheap. +200% later, and the picture have changed. I’ll be going through a reverse DCF and try to modell out a growth trajectory for Norbit. A fun note, the last time I did this exercise, the market priced Norbit to grow at a 2% rate for year 1-5. Talk about an insane miss.

We can see that the markets are far more bullish on Norbit nowadays. With a share price of around 211NOK (time of writing 12.06), the expectations are bullish.

Assuming the guidance from management is going to be adjusted up from NOK2.2 - 2.3bln to the range of NOK2.5 - 2.8bln, we should see a growth range between 42.8 - 59.9% for FY25 compared to FY24. If it normalizes to the range of 18 - 25% (a strong but feasible growth) year 2 - 5, it looks like Norbit is fairly priced.

Now the tough task is to meet the long term expectations of 14% after year 5. That’s a very bullish assumption, so we might see that Norbits valuation is stretched by a bit.

But, the structural trend of automatisation in ocean exploration (demand for sonars), and digitization of transport could drive growth for many years going forward. However, compared to a year ago, where the market barely expected anything from Norbit the bar has been thoroughly raised.

I’ll add that if I adjust the discount rate to 10%, there are far more reasonable growth expectations baked into it. I’m not comfortable with having that as my baseline - we need to remember that the demand for Oceans and PIR in particular is cyclical.

Growth algorithm

In my earlier posts where I’ve included valuations I’ve done simple multiple-plots. I want to try to move away from it and start doing more growth and margin assumptions.

Let’s be mindful that there are many moving parts for Norbit. The more assumptions we make, the more likely we are to make mistakes. I want readers to take note that I am sure I am going to be wrong.

I try to model with conservatism. In my following growth model I’ve accounted for the growth and margin targets stated in Norbits 2027 Ambitions (per annual report 2024). I like to remind everyone that Norbit has constantly underpromised and overdelivered, and they have stated that the guidance for FY2024 appears to be conservative. That is however no reason for us to get ahead of ourselves.

Before we continue, I find it timely to remind everyone that this is Norbit’s historically achieved growth rates:

Revenue CAGR

2016 - 2024: 25%

2020 - 2024: 29.8%

EBIT CAGR

2018 - 2024: 42.2%

2020 - 2024: 67.2%

As we can see, there’s been a lot of margin expansion and operational leverage in Norbit since 2018. Particularly since the IPO (mid 2019, first AR as a listed company was in 2020). I doubt we’ll see the same growth rates being achieved in the current phase of Norbit.

The guided growth is as follows:

Without further ado, here’s how I envision Norbit organically growing for the coming 10 year horizon. Please take note that my baseline for assumptions are on a rolling 12 month basis - this implies that the stated dates are also on the forward 12 months rolling (i.e. 2025 = Q2’25 - Q1’26, and so on).

As you can observe, I am quite bullish on the coming years. I believe we’ll see strong operational leverage across all segments for the coming three years.

Having earlier outlined that I believe we’ll see margin expansion across the two product segments: Connectivity and Oceans due to scale in both production and customer starts to seep in.

You might note that my assumptions for growth in 2025 might appear to be a bit low (at 2.35bln NOK for the coming 12 months). That’s a result of Oceans having to lap extremely strong 2024 Q4 and 2025 Q1 results.

I have been a lot back and forth at what growth rates would be justified for Oceans in the next 12 months, and I strongly suspect I will have to change my estimates when we get more information in the Q2 presentation.

Make me happy - buy me a cup of coffee:

Oceans

I’ve accounted for a gradual margin-expansion with margins topping out at 37% for Oceans. This might be bullish, but given the rolling 12 month margin of ~34% and room for much larger customers and orders to move in - I believe it’s a reasonable assumption for Oceans to achieve 37% EBIT margins over time.

Given the strong results the last two quarters, I expect the coming 24 months to be tougher in terms of revenue growth. I feel like I might be a tad conservative with my expected growth in Oceans, but I prefer to be on the conservative side here.

Oceans historical growth (2019 - R12 Q1 2025)

Revenue: 249.0 → 855.2 NOK million = 23.0% CAGR

EBIT: 50.6 → 290.5 NOK million = 34.0% CAGR

Connectivity

In Connectivity the reason I expect us to see a gradual margin expansion is due to larger customers and more made-to-order sales moving into the sales mix. We’re moving from parts into full products for Norbit Connectivity. This should have a strong impact on margins. I furthermore expect that these margins will top out, and start declining after competitors catch on.

Connectivity is one of the sectors where we might see new use cases start popping up. It’s hard to know what Norbit will be making money from, as they work in a very explorative way.

Connectivity historical growth (2019 - R12 Q1 2025):

Revenue: 249.0 → 855.2 NOK million = 23.0% CAGR

EBIT: 50.6 → 290.5 NOK million = 34.0% CAGR

Product Innovation and Realization

This is the current hot segment of Norbit. I’ve modelled an exceptionally strong growth rate for the forward 12 months rolling at 60%, and I’ve assumed a margin of 15% for the same period. I believe that the defense spending will continue to provide strong growth for year 1-3 in the model, before margins and growth rates start declining to historical and sectorial averages.

PIR historical growth (2019 - R12 Q1 2025):

Revenue: 259.9 → 558.5 NOK million = 13.6% CAGR

EBIT: 4.4 → 72.2 NOK million = 58.1% CAGR

Costs

I assume that we will see inflation+ growth in many of the cost categories. I expect growth capex to fall a bit going forward, but remain the main portion of CAPEX spend. For maintenance capex I model a 4% growth in costs associated with replacement of production facilities. I assume a mix of growth/maintenance as:

g80%/m20% of R&D. These costs are often accrued when customers want small adaptions on products, or big mission oriented contracts such as the Toll4Europe contract.

g40%/m60% of PPE. These costs are usually replacements or expansion for machinery and property upkeep. Norbit usually invest a lot in new and more efficient production lines, but given a depreciation period on machinery of 5 - 7 years we should see steady replacements.

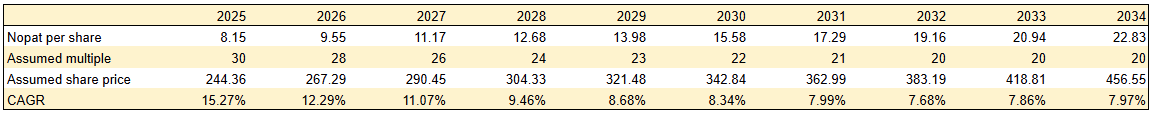

Assumed share price CAGR, Norbit R12 2025 - R12 2034

The above model results in a rather front loaded return on investments, not surprising given the strong assumptions made for 2025 - 2027. It’s easier to be confidently bullish on the coming three years as we have more or less clear visibility on Norbits target growth.

The management’s current forward looking guidance at a 2.7bln NOK in 2027. They also guide quite conservatively for their margins throughout segments. I don’t find it likely that they’ll be going for these types of margins going forward. When the guidance was made sometime last year, they weren’t seeing the same scale of orders and customers as they currently are. I suspect that particularly Oceans will see margins be lifted in the next long-term guidance from Norbit.

With the growth assumptions that I’ve made, I also suspect that they’ll meet their revenue target a whole year ahead of schedule. I do however include Innomar as a part of my growth algorithm, which their organic goal does not. Norbits management has guided for an additional 10% of growth via acquisitions over time. That is not included in my model. I also do not include any share buybacks or dividends - these are hard to model out, and I like to have them as positive optionalities.

I assume that we will see a forward 20x steady state NOPAT for Norbit beyond 2030. Simply because they’re positioned in the midst of many megatrends: Automation, ocean mapping, efficiency effects in transportation and so on. This is however a lofty valuation, and puts Norbit in the elite of companies in terms of multiples.

The 10 year CAGR for Norbit ends up at around 8%. Given the low confidence for modelling high growth rates for the product segments, that’s a pretty attractive return. We’ve come of a couple of years where past investments have shown an extremely attractive pay-off due to product innovations and deepening customer partnerships. I don’t believe that is a happy coincidence for Norbit, and expect them to be able to continue to deliver on both products and innovations, but I also don’t want to have to strong confidence on high growth rates on the back of a wide range of outcomes that has low visibility.

For the 8% return, we should conceptually add in dividends and acquisitions, and I think it’s reasonable to say that we should expect returns exceed 8%, and probably land in the range of 8-11% annually over the coming ten years.

If Norbit continues as they have these last three years on the innovation front, I think we’ll see returns far outsize my assumptions. Per Jørgen Weisethaunet talked about this in a recent interview, where he said (paraphrased and translated):

When we went public five years ago, many people asked us what we thought we would be making in five years time, and how much we would earn. I responded that I did not know what we were going to make and how much we will earn, but I know it will be something we can’t imagine right now - and we’ll earn more than we do today.

And for those who want to know where I think Norbit is in five years time, I have the same answer now as then: I don’t really know. But we will continue to explore more, approach innovation through our customers viewpoint and solve new problems.

Outlook

We can’t say that the case for Norbit is as attractive as it was just 12 months ago. The organic returns from here on out are in the high single digits range, but add in dividends and acquisitions and we might see better returns. Again, my imagination can’t really capture reasonable and rational ways to assume growth at historical levels going forward, but as Norbit has proven before: There’s new problems to solve through explorative engineering. Personally, I find the company to still provide an attractive investment case going forward.

A lot of answers will be given in the next three quarters. Management has said that their 2025 guidance is too conservative, and we are bound to see numbers revised upwards.

The big question is: When will they revisit their longer term guidance? I suspect that Norbit will achieve their 2027 targets at least one year ahead of schedule. What are the new targets then? Will we see growth targets into the 2030s? And what margins does management believe in given the scale that has been achieved since they last posted longer term goals? We will have to wait and see.

That’s what I wanted to touch on today! Thank you for reading my Norbit Deep Dive part 2, One year later. I hope this has helped you better understand the company.

If you want to contribute to this passion project of mine, feel free to pitch in for a cup of coffee via this link:

As always: None of this should be understood as investment advice. I am a hobby investor, with no professional training. I may sell or buy stocks without disclosing it at once, so you should not be following me. Do your own research, or you are bound to lose conviction when conviction matters.

Great reflections, and great call on Norbit. Congrats. Keep it going.

Wonderful, thank you.