Dear readers,

At the turn of the year it is a common practice of investors to make some bold predictions for the year. I’ve registered that this is something that people like, but also that it has (rightfully) garnered some criticism.

I’m inclined to agree with

arguments. Making predictions on a one year frame is a tough one, and I do not want my readers to believe that my picks here are an attempt at selling you a done deal. But, taking a stance on short term price movements combined with solid history for fundamental performance (i.e. EPS/FCF/NOPAT per share growth) and long term quality growth prospects is in my opinion not at worst an entertaining attempt at looking into the future.So, now that the rightful disclaimers are shared, let me present my five top picks for 2025:

Number 5: Momentum Group

This is a rather fresh company for me. I’ve had them on my watchlist for around half a year, and I have been impressed by their performance. Momentum Group is a serial acquirer of producers and distributors of niche industry components. They are run by two key people with an impressive track record, Ulf Lillius and Niklas Enmark. Ulf managed to deliver some astonishing results with B&B Tools, where shares gave a CAGR of 42% under his leadership! Niklas Enmark has done his time in Lagercrantz AB, where he worked as CFO from 2004 to 2011 and he can “only” brag of around 20% CAGR during his time with the company. Momentum Group has compounded EBITA at 28% since their real listing in 2022, and have a goal of achieving 15% annual EBITA growth over time. If we assume they’ll achieve their goal (i.e. fall a bit behind current growth), we are looking at P/EBITA FY25 23x, and 20.1x FY26 EBITA. It’s not cheap, but it’s not too expensive either.

Momentum Group is the only one of my top 5 picks I do not hold shares in, but I am looking to open a position currently.

I’ve attached a quote from REQ Capitals great introduction toMomentum Group in their annual letter below:

Number 4: Linde PLC

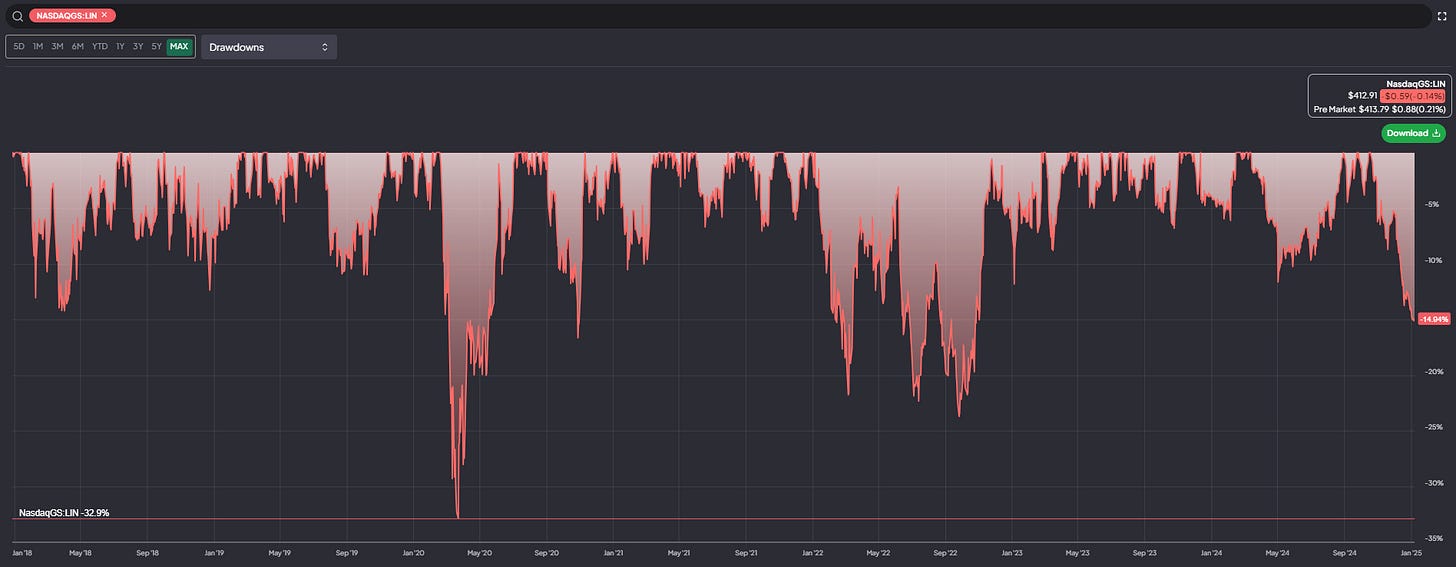

My pick for number 4 is an industrial giant. Despite its size and track record, Linde PLC is a company to few people talk about. The shares have had a fantastic run after the merger between Linde and Praxair, and we are currently in one of the largest drawdowns in recent times. They sport a highly defensible distribution business model, with a best in class return on capital metrics and some exciting optionality in green technology. Linde PLC is a sleep well at night pick, that is a great choice for investors looking for slow-and-steady growers.

Linde is an excellent company in and of itself. As a producer and distributor of industrial gases they are often a key or integrated part of their clients value creation chain. This is one of the companies that gain value from making their customers' lives easier and better, and through disciplined running of the company make a great investment for those of us looking to sleep soundly.

Number 3: Topicus

This was a toss-up between Constellation Software and Topicus, and I could’ve picked either of them. The mothership is probably the safe bet in this case, but Topicus have recently started ramping up acquisitions. Combine this with the share price performance of the last three years between the three listed Constellation companies (CSU, Lumine, Topicus) I find it sensible to assume that Topicus might have some chances of outperforming it’s family members. I think it is fair to say that if we zoom out to a five year perspective, the outperformance is not as big, but still noticeable.

Topicus remains a great company in my opinion, with a large addressable market and a playbook and know-how of running a great defensible serial acquirer. Let’s see how the year goes, but I’m pretty confident in the CSU family for 2025 as well. There’s much to be said of Constellation, Topicus and Lumine, but in this post I prefer to keep it simple. There are many good reasons for the outperformance of Constellation and Lumine vs. Topicus, as the valuations do not hold the same size of discrepancies as the share price performances between the companies. But sometimes I prefer this commonsensical approach to the short term, and I would not be surprised if investors look to take action on this widening performance gap among the Constellation names.

Like these graphs? Get a 15% discount and support this publication through the link below:

Number 2: Evolution AB*

The online casino juggernaut, once a favourite of investors but has fallen from grace due to a slowing in growth (top and bottom line). If we look at the numbers more closely, Evolution still sports some great fundamental numbers. Double digit growth, very healthy return on invested capital and excellent margins. Now you can invest in the company for low double digit P/E multiples. I don’t think this makes sense. It’s a great company, trading at a shit price. But they can also not go more than a couple of weeks before major news hit. I have made Evolution AB my second biggest position for 2025, and think we have a potential to snag a great company at a great price.

Number 1: SanLorenzo

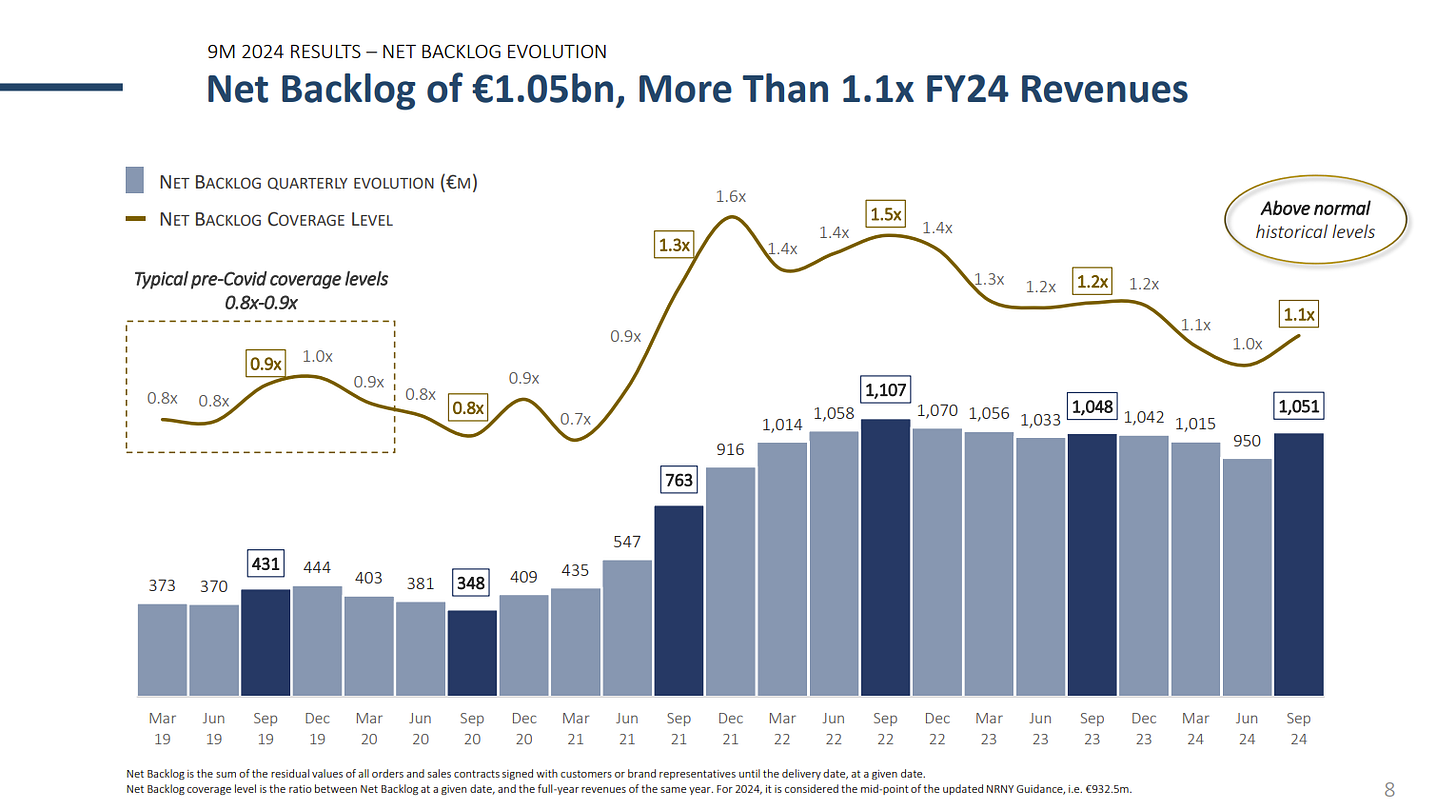

My favourite pick of the year is SanLorenzo. This luxury yacht-maker is in a better than ever position after acquiring the luxury sailboat maker, NautorSwan, last fall. With record backlogs and new orders, priced at a multiple we haven’t seen since they started seizing oligarch yachts in Europe after the invasion of Ukraine I think it’s a great deal. One of the risks is if SL starts hoarding cash, but they seem to be intent on buying back shares at great opportunities, and have deployed a fair bit of capital towards NautorSwan. If the market realize that filthy rich people are still buying unreasonably large boats then shareholders should be in for a nice ride.

Two wildcards

I always struggle restricting myself. Five picks should be plenty of space, but I figured readers would be curious about some potentially good picks that I haven’t got the confidence in (The first due to lack of cash flow confirmation, the second for lack of time to research).

1. Omda AS

I’ve owned and talked about this company a couple of times in my newsletter. I hesitated including it in the top five picks, but these bold predictions deserve some bold picks. Omda is a Norwegian serial acquirer of healthcare software with a strategy of rolling up software companies and growing through upselling and long contracts with solid customers such as hospitals, regional authorities et.c.

The shareprice has rightfully been punished, with negative earnings and high interest expenses and personell costs eating at their ability to generate free cash flow. But, during the late part of the winter Omda started acquiring again after re-negotiating their bond agreement. Now I believe there is a chance that Omda is set to face several catalysts in the year to come: 1. There is good chances for them turning cash-flow positive, 2. acquisitions ticking up (combined smart dealmaking as evident by the way they’ve handled the Aweria deal), 3. margins are set to improve after cost-cutting initiatives.

It’s a tough call, and the range of outcomes here is still too wide for my preferences, so I do not own shares right now.

2. Vysarn Ltd

Vysarn LTD is an Australian acquirer of water services companies. They own companies throughout the water value chain, everything from drilling services to drain water repositories adjacent to mining, to purifying and handling of water resources as well as water rights. I’ve had half an eye on Vysarn for the past nine months or so, but never pulled the trigger as I am a bit hesitant to buy into shares moving upwards rapidly.

But Vysarn seems to perform in line with management’s promises, they have a lot of room to grow in an attractive and important market. Peter Hutchinson, Chairman of Vysarn and key owner has a track-record of solid results and they seem to be the real deal. Currently valued at around 13x operating profits for 2025 they are also quite reasonably priced (despite the astonishing share price performance of 2024).

Wrapping things up

That was all the bold calls I felt like making for now. I feel confident for my portfolios ability to continue to grow in 2025, and see some good opportunities showing up on my radar. It’s hopefully going to be another good year, but I would not be surprised if we see a lot of volatility. My picks all have good cashflows, isolated from the doldrums of the markets so let’s cross our fingers and see how it goes.

Thank you for reading, and as always, let’s keep compounding!

None of this should be understood as investment advice. I am simply a happy hobby investor and far from a trained professional. Do your own due diligence, and put in the work!

*I started writing this post on January 6th, the day before the announcement that the long standing CFO of Evolution AB, Jacob Kaplan, stepped down. Given that the share price has really been struggling and Evolution had it’s worst year ever I believe it is prudent for investors to be on watch for potential changes. It has been hard to understand why the market has been pricing Evolution as it has, but if the market knows something individual investors don’t and Kaplans leaving is due to something happening behind the scenes this might get ugly. Evolution commented on Kaplans departure saying it had nothing to do with the stock market performance, and that it was simply due to personal matters and the want for new challenges. They couldn’t really say anything else of course, so it’s hard to take these “nothing special here folks, move along” without a healthy dose of skepticism. It does not help that the new CFO background is from Kinnevik and Cint As, two companies who’ve destroyed shareholder value over a long period of time.

Nice write up. What’s the insider ownership for SL and VYS? I’ve seen Vysarn mentioned a few times on Fintwit. I need to dive deeper into that one.