Interesting insights - February 2025

You don't need a weatherman to know which way the wind blows.

Dear readers,

Let me begin with some personal reflections rather than jumping straight to the markets. This month the biopic “A Complete Unknown” launched, and I caught the film on its launch weekend. I’m a big folk and Bob Dylan fan.

My favourite moment in the movie was seeing Chalamet-Dylans interaction with Woody Guthrie. I’ve always admired the naive courage that Dylan showed when he hitchhiked across the country to meet Guthrie, his musical hero. Woody is one of those artists I’ve come to love, largely thanks to Bob. Dylans fan-girling is as beautiful as it could ever be in his song to Woody. Dylan in his early days was a focused and obsessed fellow, he slept with his guitar and listened to music from artists he admired for full days. A genious in the making.

The last month has been chaotic. The fundament that my country (Norway), my continent (Europe) and the world in which I share values with (“the west”) has been shaken. As usual, I suspect things feel more dramatic than they are. However, the current U.S. administration has made one of my favourite satirical songs by Guthrie, Lindbergh, feel more relevant than ever.

Alright, that was as political and music-ally as I’ll get. Thank you for bearing with a Dylan fan who thinks he sees some historical paralells to what his heros sang about.

Mr. Markets mood

At one point in February I felt like doing a victory lap, as my returns peaked at 15% YTD. It’s safe to say that the mood has soured towards the end of the month, and my returns have come down to more “reasonable” levels of +11% year to date. It is still a pretty wild return, that I would be surprised if lasts long. I aim for between 12 - 15% a year in average. 11% in two months is probably not sustainable.

It’s hard to see how things aren’t going to turn bad from here on out. As mentioned in the introduction things seem to be sliding into a new geopolitical world order. Politics and presidents have a tendency not to affect stock prices in the long term. Why should this time be different? I do not know that - but since the end of World War II the alliance between the U.S., Europe, Canada, Australia and Japan have held strong. We’re seeing this world order potentially being tossed in the air currently.

Then again, when COVID hit we could’ve said the same: We haven’t had a global pandemic in modern times: All is going to shit! Some years later, the markets have shrugged this cataclysm off. Who knows what happens in the future? I don’t - pretty much every time I try to predict how the world will turn, I am wrong. Therefore I won’t let this dictate my investing.

There are additional signs that inflation looks to rebound, and the economy is weakening. Let’s see how it goes. I own companies in which I am confident that they are positioned to weather potential downturns or macro-headwinds. As Andy Grove, Co-Founder of Intel once said:

"Bad companies are destroyed by crisis, good companies survive them, great companies are improved by them."

Portfolio happenings

This is how my portfolio is at the moment:

Several notable changes occurred in the portfolio this month:

Exits

Linde - Sold for a modest profit despite my high regard for the company. Two reasons: 1) The addition of Fairfax skewed my portfolio too defensive, and 2) I couldn't build Linde to my target 10% position due to brief share price weakness.

Gofore Oyj - Exited after disappointing results from other IT consultants reduced my conviction in this smaller position.

O'Reilly Automotive - Sold after locking in 40% gains over one year. Current valuation appears stretched with forward CAGR expectations of only 5-7%. Even with buybacks, returns look unattractive given the high multiple and risk of contraction.

Additions

Harvia - Initiated position after a 13% post-earnings drop when the market overreacted to increased marketing spend. This sauna market leader has double-digit growth potential for 5-10 years as the company rides secular trends in major markets.

Fairfax Financial Holdings - Added after deeper analysis revealed multiple layers of value. The company combines excellent underwriting growth, portfolio accretion, and strong shareholder returns at a discount to peers.

Evolution AB - Increased position in this market leader trading at an unusually attractive multiple.

Introductionary comments on Harvia:

The king in the sauna market, Harvia, has been a company that I’ve followed for over a year now. I’ve been stuck on the sidelines, firmly anchored to the price in the mid 20 euros that I was considering buying it for in the beginning of 2024. A big mistake on my part. When earnings reactions to Harvia expanding their spend on marketing to take further market share was to send the share down by 13% on the day I opened a position. It seemed to be a big lapse of judgment by Mr. Market. I am incredibly enthusiastic about Harvia as a company, and believe they will serve me well for many years to come. This is one I am looking to add to with additional savings.

Introductionary comments on Fairfax:

Fairfax Financial Holdings is a lesson for me in not paying attention to company names smart people mention. In an investor community I am active in this was mentioned in the summer of 2024 - I brushed it aside. When I started looking into it in January, every layer of insight gained made me realize what an opportunity this is. In several conversations I’ve described Fairfax as a value-bambushka: Every little doll of value you open presents new value. I have elaborated on Fairfax in my subscriber chat, and if you want to follow my moves I’ll be sure to keep the chat up to date with what I’m thinking and doing on a more regular basis than per month.

Now, finding the price to assets and income is a bit silly and probably double counting - but I find it very illuminating to see the amount of value hiding under the hood of Fairfax. The company is currently priced attractively compared to other P/C insurance companies that are natural to compare it with (curtesy of Viking who know Fairfax extremely well):

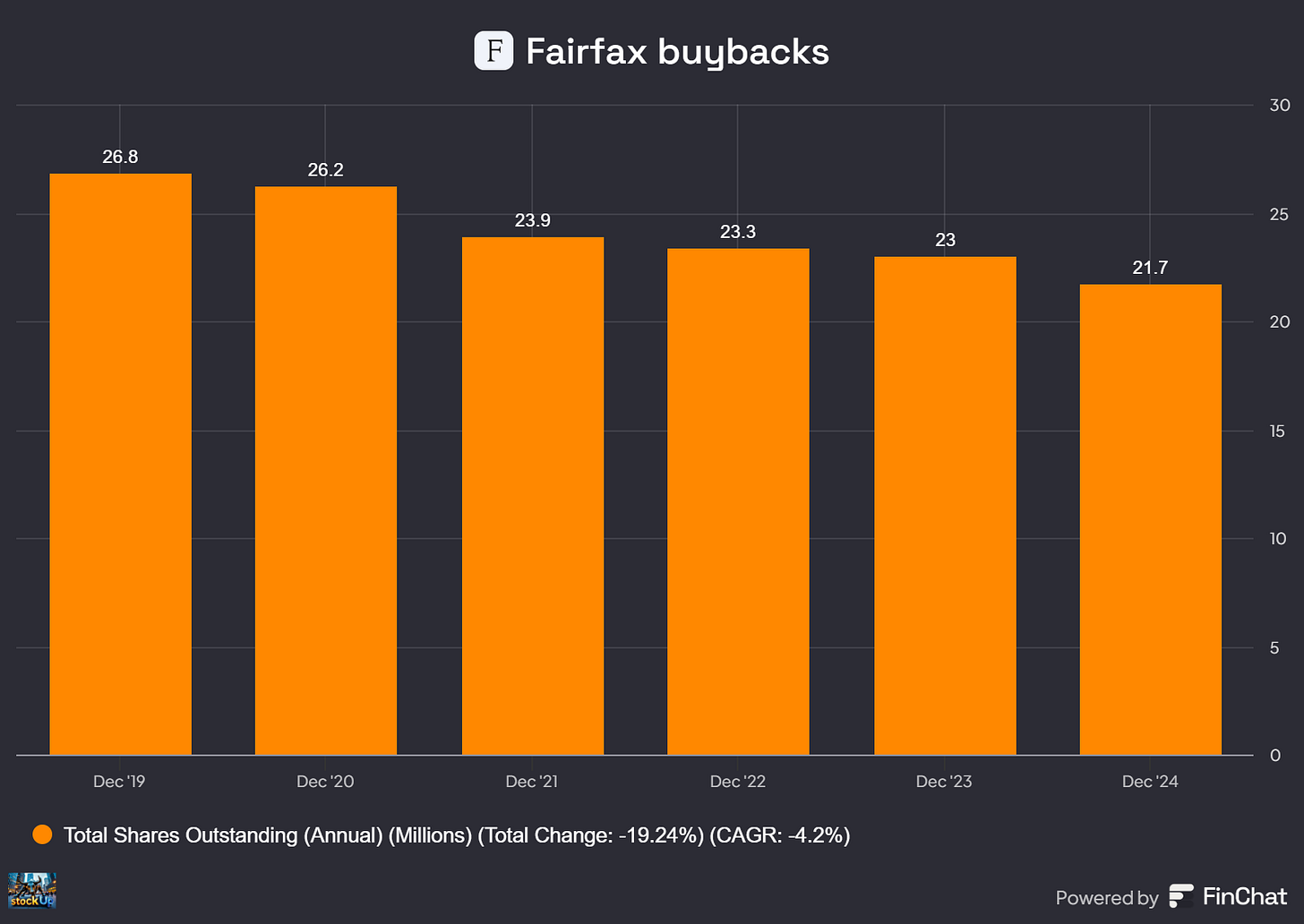

We can currently buy the best performing company in terms of underwriting growth, portfolio accretion, and total shareholder return (shareprice+dividends) for the cheapest price amongst peers. Fairfax is turning into a share cannibal infront of our eyes as well.

The add to my Evolution position seems like a prudent move in an overpriced market. We have the opportunity to buy a market leader with world-class metrics for a multiple that is close to unheard of. I’ve commented a lot on Evolution over my posts the last years, so I’ll leave it at that for now.

Earnings commentary

Four companies within my portfolio have reported earnings since my last monthly summary. On a top level I would say: Two homeruns, one OK and one meh result.

Momentum Group full year 2024

Let’s start with the meh result: Momentum Group AB had a weak quarter in my opinion. I would summarize it as follows:

Soft Q4 EBITA +22% YoY

Net profit in the quarter was slightly disapointing

Infra segment doing well: EBITA/WC 55% → 60% '24 M&A avg multiple is 6x EBITA

Profitability staying strong YoY, but Q4 hit by one-offs (moving main warehouse & M&A amortization)

The thesis I wrote on Momentum Group is still very much intact, and I am looking forward to having this great little gem in my portfolio for years to come. Read my deep-dive here:

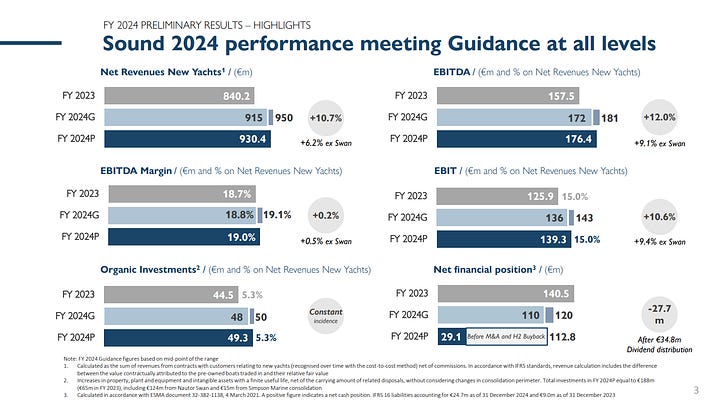

SanLorenzo prelimenary full year 2024

SanLorenzo presented OK results:

Superyacht sales presented very strong numbers, at 17.6% YOY growth (23.2% in Q4).

Americas and MEA grew very well in 2024: Americas up 58.4% and MEA up 55.4%

Muted development in Bluegame and Yacht, where the former was up 1% YOY (-4.5% in Q4) and the latter up 1.8% (+9.9% in Q4).

In my opinion it seems like it is smooth sailing for SanLorenzo right now. I remain optimistic for an acceleration in 2025 via the U.S. markets and Swan. We probably need to see some growth in the order-intake for the markets to lose it’s pessimism towards this still cheaply priced quality company.

SanLorenzo remains at the top of my portfolio, with a ~12.5% weighing, and I am very comfortable with my overweight position as current pricing leaves a lot of upside.

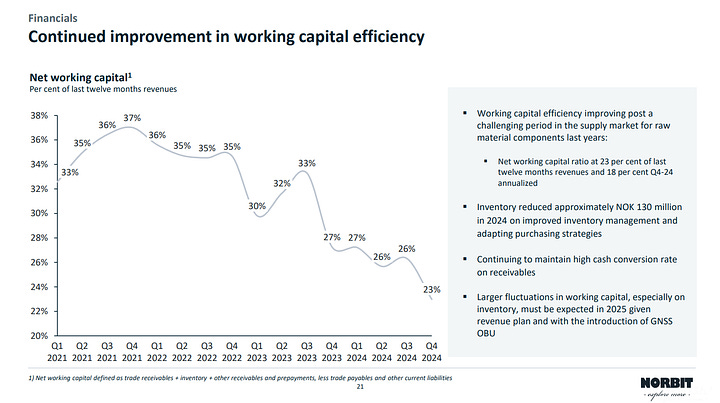

Norbit FY2024 results

Norbit presented results that were quite frankly amazing.

Their full 2024 results showed us record revenues and strong margins across all segments.

+52% rev growth in Oceans (32% standalone revenue growth, i.e. excluding Innomar!)

+31% rev growth in Connectivty (excluding some bigger orders that has been postponed)

+32% rev growth in PIR (which has been struggling a bit, posting these results while the rest of the contract manufacturing sector is struggling quite a lot is very impressive)

Norbit still sports a pretty reasonable price. I would not be surprised if we land on a 23% EBITA margin, and with managements guidance of 2.15bln NOK revenue we are currently trading at around 14x 2025 EBITA. I’m also quite confident in that the management will be reaching their 2027 targets some time in 2026, triggering the need for new guidance.

The balance sheet of Norbit has become less leveraged since the acquisition of Innomar, leaving room for M&A optionality. Q4 also showed us that profitability is improving across all segments, and their return on capital is steadily growing despite only having earnings from Innomar for half a year. I believe we’ll see Innomar improve under the wings of Norbit, much the way Ping DSP has improved since joining Norbit.

Add in that the company has a great management focused on the right things, that they are positioned within some very attractive end markets with market leading niche products and we have the recipe for a long term compounder in my opinion.

Norbit is in my opinion a viable candidate for an extremely attractive long-term compounder still trading at reasonable levels. I’ve attached a must read report from Erik Stangeland in the knowledge corner at the bottom of this edition.

Topicus Q4 and FY2024

Topicus presented some excellent results showing margin improvement and growth that exceeded my expectations. 2024 was a slow year in terms of cash deployment, but Topicus has really amped up their acquisitions and investments. This leads me to think that the best is still ahead of us. The highlights of the report were:

+32% net income YOY (despite a substantial tax increase in Q4)

FCFA2S +27%

EBITA marginer at 28.5%

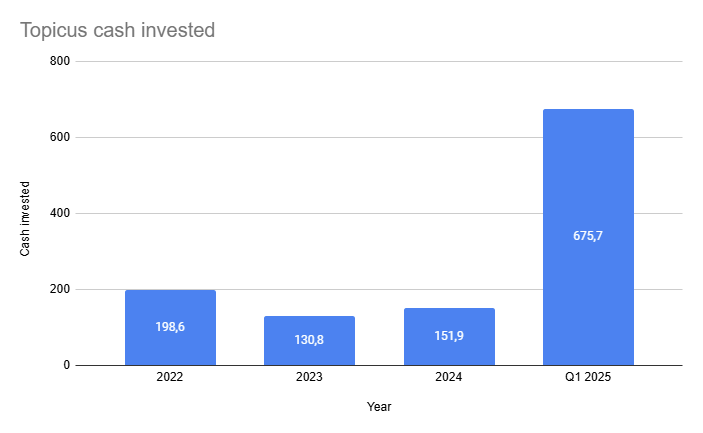

As we know, the markets are forward looking, and we can only grow our portfolio by having companies perform going forward - nobody is going to pay a higher price for a share because it did well yesterday, only because it’ll do better tomorrow. That is very much the case with Topicus - the excellent Q4 results were on the basis of last years muted activity. In Q1, Topicus has really amped up their M&A and investments. Below you’ll see the cash deployed in Q1 compared to the three years preceding:

I am feeling quite confident in that the best is ahead of us in terms of Topicus.

Watchlist February-update

This is a new addition to my monthly letter. I will start to report the companies entering and/or leaving my watchlist on a monthly basis.

This month I’ve added three companies to the watchlist:

Nubank - I’ve followed this company for around a year or so (at the same time I started paying attention to Mercado Libre). I am deeply impressed by Nubank, and it might very well enter my portfolio in the near future.

Greggs PLC - Greggs looks to be the sort of company I’d love to own. It’s a boring, but steady compounder. They allow customers to take part of the value creation of scale economics by ensuring having the best quality for the best price out there. Greggs is a dominant force in the UK snacks and food-to-go, and each time I chat with a Brit they always shower Greggs with praise.

Berkshire Hathway - How have I not had this on my watchlist before? Well, alongside investing in Fairfax I’ve spent quite some time studying this business history, and it’s a great one! Currently it feels too much of a common holding with too high a market cap for me to find better-than-average results, but Berkshire might just be a good alternative to cash if valuations get even more crazy going forward.

Kraken Robotics - Reading more about the UUV trends, this name has popped up in several conversations. I want to follow the company and try to better understand its competitive advantages and position in a fast moving market.

I have removed: Fairfax Financial Holdings (entered portfolio), NCAB Group (lost conviction). O’Reilly and Linde added back after leaving the portfolio.

Knowledge corner

Podcast highlights

These episodes provide great discussions on Nubank and it’s rise, advantages and business model. I suspect Nubank is a potential long term winner that deserves investors attention. David Velez and his team sounds like a very impressive bunch of operators achieving things that seem almost impossible.

A 10/10 discussion on returns, reinvestments and investment gains. I want to own companies that can spend their operational earnings to grow their businesses and expand their revenues. Loved this conversation.

When one of my favourite podcasts talks about my favourite artists I can’t not recommend it. Bob Dylan is a person in which we should all aspire to learn something from. Great episode!

This discussion on Fairfax is a great introduction to what I suspect is one of the best opportunities in todays markets.

As always, whenever Howard Marks releases something, there’s a ton to gain from listening or reading what he is thinking about.

This episode is a gem of a discussion in terms of Evolution AB. Todd Haushalter is a thoroughly impressive person, and I believe Evolution is in extremely good hands in terms of product-development.

Essential reads

I love me some annual letters and reports from funds that act as rational and great investors. This one is a great investment memo by River Oak Capital, a small cap active fund.

One year old report on Greggs PLC - well worth the read for readers interested in learning more about the company

As always, Ole provides some excellent insights into exciting companies. Shift4 is a very compelling case, that has had some developments lately.

Fairfax Financial must-reads:

Great post on Fairfax:

Arne Ulland who writes under the Torghatten Capital name on Substack released his annual letter - a must read:

A must read for any Norbit investor out there is this deep dive into the Oceans segment of Norbit.

Looking ahead

I want to share an idea I’ve been toying with for a good while in terms of portfolio strategy. This is not something I’ve decided on, but I feel more and more drawn to this idea.

My current portfolio is based on the idea of a bunch of great, long-term compounding themes: True luxury, small cap champions, capital allocators and toll-gate network economics. I am currently contemplating simplifying my portfolio into two baskets:

Larger market cap companies within the theme of capital allocators. This means serial acquirers, holding companies, trusts or thematic funds and investment companies.

Smaller market cap champions: Great niche companies with a smaller market cap that are leading their markets with better returns on capital than their competition. This would be companies that are breaking through and showing strength in niches, and that are young companies.

I’ve slowly been moving in that direction through sheer preference. Currently there are only three companies in my portfolio in which I would not define within these baskets: Ferrari, Visa and Evolution AB. All of these are market leaders with enormous economics. I’m not sure it is a wise idea to limit myself to much in terms of owning these types of companies - though the idea of simplicity and focus is very enticing currently. If I were to make such a change, I would do it deliberately and after a lot of consideration.

The idea is that I’ll spend more time looking at small cap opportunities, and let capital allocators handle the “big” cap investments through firms like insurance float investors (FFH), serial acquirers and holding companies (CSU, MMGR, Investor AB et.c.) and potential trust (Scottish Mortgage and HG Trust seem interesting). That will allow me to focus on understanding great capital allocators at the high level, and identifying companies with huge right tail potential.

I will not hold you much longer, I just want to comment on that I am going to be structuring my work with the Substack to a higher degree. I currently post around twice a month. I want to be able to post more regularly, and try to write shorter pieces where I don’t doodle on into infinity. Be tuned for more posts!

Until next time,

Mathias

Disclaimer: This newsletter contains my personal investment journey and thought process. Nothing in this newsletter constitutes financial advice. Always conduct your own research and consider your unique financial situation before making investment decisions.

Always interesting to read you, keep going and thank you