Lessons learned in 2024

What have I learned from last year, what are my goals for 2025 and how were my results in 2024?

Dear readers,

2024 has been one hell of a year. In this article I want to spend some time reflecting on what lessons I have picked up over the year. I will focus on the stupid stuff I have done and go through my portfolio turnover, as well as try to look ahead to 2025 for my portfolio.

Some background

Personally this has been the first year in which I’ve taken my investing seriously. Of course, had past me met present me: “I am taking it seriously”, past me said. But my retort would be: You’re not doing the work.

Why am I doing the work now and not then? I’ve taken several steps this year, I have:

Established a framework for evaluating great companies (reverse DCF, exit multiple spreads)

Created a mix of qualitative and quantitative criterias for investing (my investment pillars)

Set myself a goal (12-15% per year) so as not to fixate on short-term volatility in my returns vs. the index

I’ve shifted away from good opportunities to great companies

In an attempt to restrain myself from the sin of selling, I’ve introduced an investable universe to set some boundaries for my exploration

I’m sure I could continue. In the end, I have had a transformable year as an individual investor. This time last year my holdings had rebounded from what at the time felt like an awful period of drawdown (more about that in a second). In 2023 I had bought my first apartment, which reset my portfolio (except for one speculative investment into a real estate company in Norway which I did not understand at all).

The years prior I had both earned, and lost money on owning shares in companies I did not understand at all, and which I couldn’t put a potential return on based on fundamentals. I can look back with happiness and see that I cut my losses in companies such as SunPower, Workhorse and Unity before shareprices took further tumbles.

However, I can also be slightly mad at myself that I sold shares in both Microsoft, Nvidia and Palantir before they rocketed on the back of the AI boom. No matter, I bought and sold without a process or any form of rationality behind it and had I owned any of the latter three I surely would’ve sold at measly gains instead of enjoy their strong share price performances. Easy come, easy go.

As mentioned, the fall of 2023 was a brutal experience for me. I re-entered the market after the cash outlay for the appartment buying, straight into a correction (looking back at it, a silly little slide). This happened to be a stroke of luck. Had I not experienced seeing my holdings slide no matter what I did, my salary chucked into a void of red numbers I would probably not have shifted from bad habits.

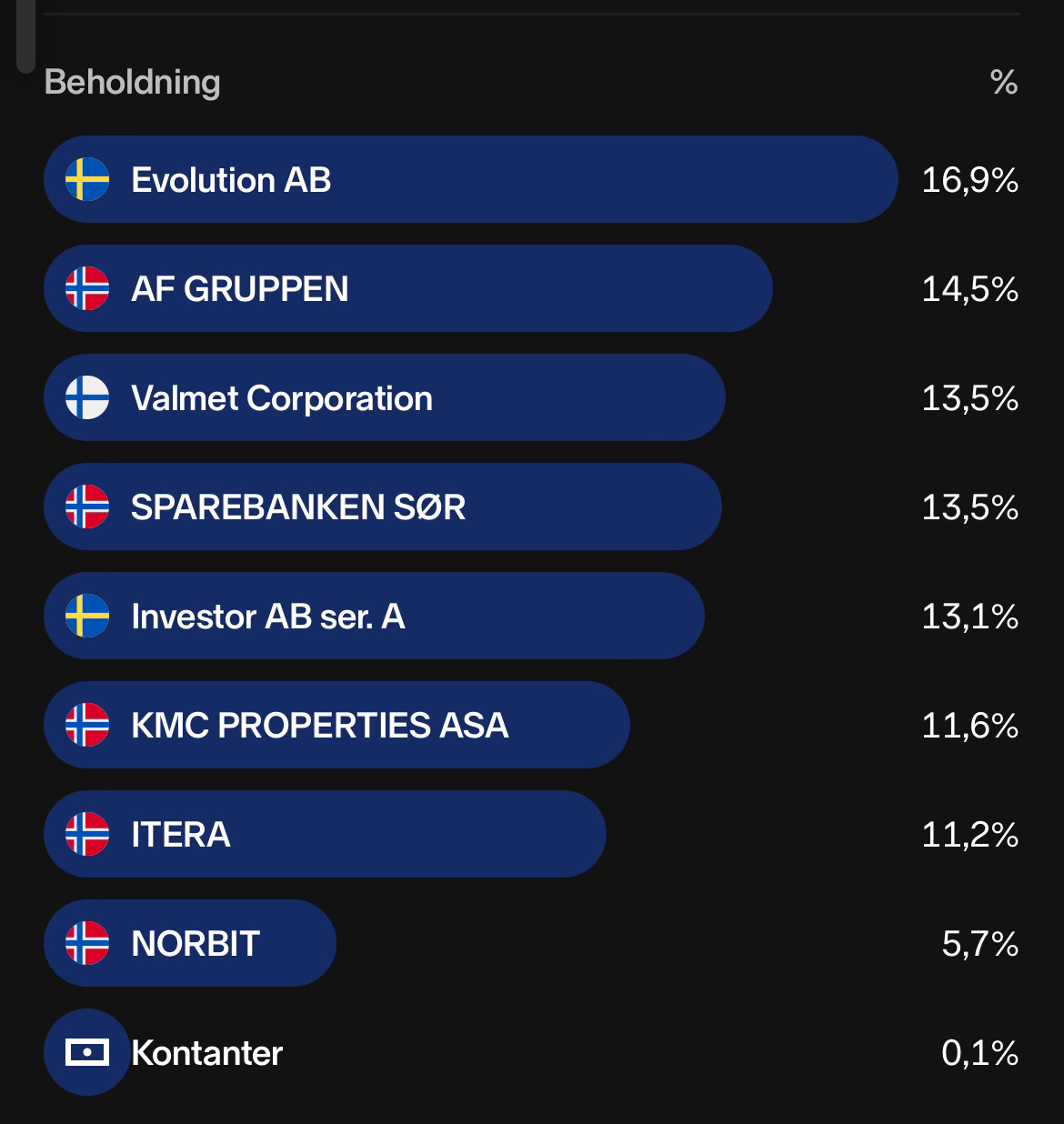

So, enough about 2023 - and thank you for bearing with me as I turn to 2024. I entered 2024 draped in the old habits of laziness. As my writing started almost in the middle of this year, I figured it would be an interesting thing to share my portfolio at the start of this year:

As is quite obvious, I have done some house-cleaning. It is probably not the correct way to describe it, as in my house cleaning some good companies have been sacrificed, and some great returns in OK companies have been lost.

2024 results for the stocks I owned entering the year (ex. dividends):

Evolution AB: -23.9%

AF Gruppen: 16.75%

Valmet: -12.06%

Sparebanken Sør: 33.2%

Investor AB: 25.5%

KMCP: This one is a bit hard to calculate as it was a part of an untraditional takeover bid with no easy way to glean the correct returns - It would’ve been a good year to hold it though.

Itera: -23%

Norbit ASA: 62.1%

My portfolio in the beginning of the year was pretty rough (companies I still own in bold). I believe I was correct in four out of six sales (I sold KMCP a bit into the year and got an alright return on it). But, this was not the only tweak I did in my portfolio throughout the year. As much as it has been a formative year for my thinking, it has been a year of moulding, shaping and changes. Let’s have a look at it.

A broadend view

Before we go on, I want to address something: During the springtime, I changed my opinion on what geography I would focus on. The idea was to stay focused on the Nordics, for two reasons: 1. The nordics have (probably) enough great companies with high quality, 2. It is usually better for taxes and fees. But, it hit me that these practicalities wasn’t a good way to limit myself and my investment. After that I changed to wanting to invest in global quality companies which hold unique competetitive advantages. There’s only a handful of those in the Nordics.

I have since changed my strategy to have great global compounders in the large cap space, and smaller niche leaders in the nordics to reap the benefits of two factos: Slow-and-steady global compounders and more specialized small-cap companies in the Nordics. In terms of geography, this is how I enter the year:

A seller’s year

As I’m sure you can understand, I’ve had a lot of time to reflect and to shape my process. This year, I’ve done far to much, in particular to much selling (but I have had to buy to sell I guess). In an attempt to both understand and be open about all my selling activity, below you’ll find a full list of my sales throughout the year.

As we can see, I have done far more than totally revamp my portfolio. I have basically revamped it many times over. It does not feel good to look back on this list, as I try to act rational and have a longer time horizon in my investing. The little shining light is that it is quite obvious that the selling activity has gone down.

My intention is not to create a scoreboard of good and bad trades. But for openness I made 23 sales with a gain, and 15 at a loss. The intention is not to look into my trading results, I’d have to find the percentage gained and the absolute amount gained as the size of the trades where different. I rather want to try to share my reasoning and understanding of the things I did wrong as to hopefully inspire others to avoid my mistakes - or to firmly set in my mind to stop doing stupid stuff.

I’ll go through five of my decision to sell or not to sell and try to gleam some learnings from them:

Sparebanken Sør

I bought shares in this company in their listing process. At the time the regional bank of southern Norway was reasonably priced, with a great balance-sheet and good prospects. The icing on the cake was that if you held shares for a period of maximum two years, you would get bonus share equal to 5% of your holdings per year held (once after 12 months, the second after 24 months). There were already speculations that the bank also might end up merging with another, bigger regional bank at a premium. I.e., it was a great deal. Oh, and I held a pretty great yield on cost as well, which I could’ve kept on my tax benefit account.

I knew all of this at the time of selling, but I overcomplicated things and figured I should cash in at a ~22% gain. Since I bought the shares, they’re up around 70% (excluding dividends and bonus shares). Sparebanken Sør would’ve been my top performer, including dividends and bonus shares my gain would be around 80%.

Lesson learned: Some deals are just as good as you think they are, don’t shy away, and don’t overcomplicate it.

Investor AB

Going into 2024, my idea was to find companies that could serve as the cornerstones of my portfolio. Investor AB was supposed to be one of these companies. However, I bought it during the fall of ‘23, and shares got a quick rebound. After the swift share recovery, I got spooked. A common (but not sophisticated) way to value Investor AB shares is to follow the current discount to net asset value compared to historical. I believe the discount to NAV was at 4-5%, whilst the historical average was 15-20%. That led me to sell.

What I wasn’t prepared for was that the companies comprising Investor ABs portfolio, a basket of high quality companies in Sweden, kept on delivering great results. After the quarterly results, the discount to NAV quickly jumped back up to 11-13%, and the shares kept on rising. Ole, who writes The Outsider Corner, presents a far better way to view valuation of Investor AB in this piece.

Lesson learned - Great companies often surprise on the upside, don’t overthink it.

Dino Polska

When Dino Polskas closest competitor Jeronimo Martins reported weaker than expected numbers the shares of DNP took a real tumble. I spent the next hours or two trying to find out why, and having to translate different polish news sites to figure out why the share price reacted what the way it did. This made me think of all the other stuff I couldn’t know about Dino Polska, and I went down the rabbithole trying to figure out how discount retailing in Poland was.

A bunch of conflicting information, and many translated posts here and there gnawed at my confidence. This was further exasparated by volatility. One of the things I value highly is my sleep, and as I kept spending energy thinking on what I knew and didn’t know about Poland, retailing and Dino Polska, I pulled the trigger and swallowed the loss.

Lesson learned - I am not comfortable in an informational disadvantage and with volatility.

Lessons from not selling

Evolution AB

Evolution AB was bought at the same time as aforementioned Investor AB. I thought of it as one of the cornerstones in my portfolio, same as with Investor AB. Where the Wallenberg holding company kept on increasing in share price, Evolution has had a bad year in the markets. Since it’s top in march 2024, the share price is down by around 34%. Based on my cost basis I’m down 12.5%. I’ve been buying most of the dips, not waiting for any confirmation on a reversal, or any notable catalyst. I believe Magnus of Disruptive Analytics raised a good point about Evolution AB this fall. The company lacks a clear story.

Right now, investors are waiting for a turn of the tides narratively and revenue growth rates to stop falling. The fundamentals for Evolution AB is in my opinion still excellent, and the downside of the investment case is quite limited. I’ve decided to wait it out (and weight it up), let’s see if 2025 is the year in which this gambling juggernaut turns it’s ship.

Lessons learned - Rage against the markets as much as you like, nobody cares about a long track record of stellar fundamentals if development is slowing and sentiment is sour.

Norbit ASA

My most successful investment (and my most successful article of the year) was Norbit Asa. This company making sonars, tolling units and much more has had a great run in the markets of 2024. I remember doing my first valuation excercise on Norbit, where I found I could reasonably expect 15% annual returns even with multiples depressing further.

After understanding the qualitative sides of the company, I bought shares. But as one often does (or well, at least think) with winners: I bought to few shares. Despite understanding the case, having high confidence in management and the business plan I only made it a small position of around 7%, and the worst of it all: I didn’t buy more on good opportunities that presented itself during the year. One of the more painful lessons of this year.

Lessons learned - Dare to really go in on your best ideas

My goals for 2025

To not stretch this out to much, based on what I’ve learned this year I’ve made a short list of goals for 2025:

Sell less, buy more (shares)

Save more (I have bought to much unneccessary stuff)

Continue learning, and challenge your assumptions

Respond rationally and calmly to development in the markets

How did 2024 go, and what to expect from 2025?

As is common in these yearly summaries, I want to present the results of 2024 based on my holdings.

International account, broker 1: +51,2%

Nordic account, broker 1: +1.52%

Euro-account, broker 2: -11.5% (basically only SanLorenzo)

Pension account (half a years history): 25%

Overall portfolio returns 2024: 24.6%

As has been the theme of the markets, the account in which I have bought mostly quality companies in the U.S. has been the by far best performer for me. Despite having my biggest winner, Norbit, in the account holding shares in nordic companies is basically flat. Evolution AB has dragged the returns down here.

Biggest winner: Norbit ASA (Total return 2024: +78.6%, overall return +85%)

Biggest loser: Evolution AB (total return 2024: -25.15%, overall return -13%)

I have been aggressively buying Evolution AB on the last share price dip after the UK regulation news, this helped out my overall return in the stock.

Overall, I’m both pleased and displeased at my results. It would not be honest of me to say that I am happy underperforming the Nasdaq index. Compared to SPY and global indexes my performance is more or less in line. Looking at my own goal, my results were twice as good as my goal is.

All in all, it was a great year, and if I could lock in 24% for 2025 now, I would take it at once.

Portfolio heading into 2025

Above you can see my current portfolio. To put a fun spin on it: I am optimistic, largely thanks to some depressed holdings.

Evolution AB and SanLorenzo are my two biggest positions, and they are also the cheapest. O’reilly Automotive holds an overweight position in my portfolio still, and I am considering changing this up. Linde has made an entry into the portfolio, as an hedge on the potential of inflation spiking up again in 2025 (the company tends to do well in turbulence and with inflation).

The markets (especially the U.S.) is looking quite expensive currently. I share the commonly held sentiment that things are looking stretched for the markets, and I struggle to see that companies can continue to surprise on the large upside currently priced in. However, there’s probably some likelihood that things continue up. We still haven’t seen speculative IPOs, there are not a lot of NFTs (shitcoins are having a ball though) and some reactions to slower than expected earning results have been quite large (i.e. rational).

I’m happy to enter the year with a mix of great companies at a discount, and great companies continuing their strong upwards trends. Let’s see how it goes, but for 2025 my goal is to side with defensible companies that have great trackrecords.

Entering 2024 my goal was to find the cornerstones of my portfolio. By cornerstones I mean companies that are global, have income streams that won’t be hit to hard by negative macro trends and that can control their own destiny. I believe I have managed to set the foundation of the portfolio.

For 2025, I’ll pay more attention to finding great opportunities in smaller companies which have larger runways for growth, and which have wider distributions of outcomes. Some of the companies on this list is:

Omda AS

Diploma PLC

Harvia Oyj

ZIGExN

GoFore

Summary

If you made it this far, I thank you for your diligence and attention. I have had a blast writing this newsletter for the year of 2024, and I will try to step up my pace of publications.

I have loved the conversations, all the feedback and the tips for company names and different authors to follow and engage with. The things that have stuck with me the most is all the learnings I get from others, and I sincerely thank everyone who reaches out with questions, comments or sharing and liking my content. Thank you all.

I wish my readers and friends an excellent 2025, let’s keep compounding!

Sounds like you vastly improved your investing process which mean there was a lot of learning on your part! Cheers to the journey and happy compounding in 2025 and onward!

What an interesting letter, thanks for sharing your learnings, both the ups and downs. Also humbled to see the Investor post shared, you have been an inspiration for my own writing. Looking forward to follow your next steps as an investor, and the writeups you post along the way. Cheers Ole